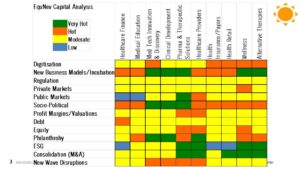

Since 2013 our algos have been accurately predicting the investment heatmap in the healthcare and life sciences in India which were predicting with 95% accuracy on the sectoral investment cycle in India till the end of 2019. Since the Covid Pandemic in 2020 we lowered levels of prediction accuracy like we started back in 2013. Covid-19 pandemic killed over 23 million people globally. 2022 has brought new headwinds, some we haven’t seen in over 40 years. Healthcare spending will fall in 2023 in real terms, given high inflation and slow economic growth, forcing difficult decisions on how to provide care. Digitalisation of the healthcare system will continue, but the use of health data will come under stricter regulation. A New world order under the current geo politics fragmentation and multilateral world is bringing India to the forefront. It’s vaccine diplomacy, effective and cost-effective therapeutic solutions is a game changer for India.

2023: A Year of Newer Normal

Since the Great Chinese famine of 1959, for the first-time life expectancy as per UN, Covid-19 had been cut by 1.7 years off global life expectancy, reducing it to 71.1 years. While a recovery probably began in 2022, the UN calculates that 2023 will be the year when life expectancy first exceeds 2019 levels. The investment thesis with most of the investment managers in the current scenario is more of a long view on healthcare infra which are less tied to economic cycles and an imminent slow down globally. Some of the investment risks the healthcare and lifesciences sector faces include rising real interest rates, increasing price inflation for healthcare products and services in the face of weakening in consumer spending, reshoring the supply chains and the wars, both trade and terriotorial. Digital businesses are equally going to be impacted. ESG and impact funding is waiting for deployment.

Let’s relook at the board trends for 2023 in terms investment activity and trends.

Healthcare Financing

2021 was an all time-high for healthcare financing sector due to emergency and non-discretionary spend on healthcare. Health Tourism related funding is only going to take off in Q3 after the current wave tides down. Consolidation activity to slow down.

2023 Outlook: Moderate

- What’s going wrong: right bite for the consumers, reach and penetration, higher debt financing costs, slower non-discretionary and elective healthcare spend, delaying of healthcare spend and health tourism, new wave restrictions, shortage of digital workforce

- What’s going right: India stack digitisation, agetech, consumer borrowing to spend on electives

Medical Education

Skilled manpower shortages is the key driver for growth. All the students who have returned back from Ukraine need to be accommodate in our current system Regulatory reforms are urgently required to push digitization and newer business models for upskilling existing workforce. Churn in ownership of assets due to consolidation activity will continues at a faster pace.

2023 Outlook: Moderate

- What’s going wrong: regulation, corruption, no vision, skill shortages, alignment to new age care, increasing debt burden

- What’s going right: skill demand, digitisation, manpower-led business models creating their own content or tying up with larger established players, cross-border students coming to India, export of clinical manpower to the West

Med Tech Innovation and Life Sciences Discovery and Clinical Development

India has proven to be the vaccine supplier to the world in 2022 with over forty percent of the world’s pre-qualified vaccine products are made in India. Capacity creation and new product development need to be accelerated particularly in infectious diseases and some niche segments. Reshoring and government policies for that need to be accelerated. Global investment and partnerships is on the rise in 2023. Patent expiry of some of the blockbusters in the US are a huge opportunity.

2023 Outlook: Moderate

- What’s going wrong: Innovation pipeline, IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration, global collaboration and partnerships

- What’s going right: Human capital, cost advantage, reshoring the supply chain, Make in India

Pharma and Therapeutic Solutions

Several players are going to go for the IPOs in 2023. Reshoring the supply chain is moving slowly. The Government production linked incentive is not moving as intended in the medtech, intermediates, APIs. The capital expenditure in creating world-class green infra is still to take off.

2023 Outlook: Hot

- What’s going wrong: price controls, policy log jam, innovation and scale up, cost competitiveness, exit of PLI incentives, scale of capex, Margins pressure, IPO valuation

- What’s going right: cost advantage, distribution infrastructure, Government incentive programs, blockbuster going off patent in the US, ESG funding entry

Healthcare Providers

2022 was a negative year for almost all the listed stocks. With higher interest rates, funding costs for have increased. Inputs such as steel, cement, etc, have also shot up increasing the capex per bed. Newer sources of funding green healthcare infra as a long-term bet which are less tied to economic cycles is emerging. Digitalisation will slow down even further as consumers go back to the old ways. Costs and profitability pressure will increase to maintain the investor interest. PE valuations will continue to get right adjusted to market valuation.

2023 Outlook: Moderate

- What’s going wrong: margin pressures, price controls, execution of programs on the ground, PPP in healthcare, supply and demand mismatch in micromarkets, debt financing costs, gun powder churn, operating cash runway, liquidity and working capital crunch

- What’s going right: Asset-lite models, demographics

Healthcare Insurance

The IPOs in 2021 in the sector have created uncertainty in valuation and investor sentiment. The sector will continue to grow as it did in 2022. New products and customer segmentation is going to be the growth drivers

2023 Outlook: Hot

- What’s going wrong: product fit to consumer needs, product approvals, loss ratios, operating cash runway, human capital reduction, consumer offtake and demand, IPOs pricing and valuation

- What’s going right: Consumer demand, digitisation, new products

Health Retail

Spends on healthcare are slowing down and so is the discretionary spend. Falling service levels and consumer trusts is at an all-time high. Costs and margin pressures is going to be more acute. Only one major IPO expected in 2023. Many of the late stage start-up are going to scale down or not raise the capital at the expected valuations.

2023 Outlook: Moderate

- What’s going wrong: regulation, consolidation, slower consumer spending, funding drying up, operating cash runway,

- What’s going right: Consolidation, newer cross-vertical innovative business models, profitability focus and valuation being right adjusted

Wellness

Growth which tapered down in 2022 is still going to be sluggish in 2023 as consumers cut back their spends. Digital business model innovation is still lagging behind. Medical wellness tourism will be recover in Q3 of 2023. Corporate Wellness spends which also scale down even further. PE funding is going to slow down even further as valuations squeeze even downwards with margin pressure. Expect one major IPO here.

2023 Outlook: Hot

- What’s going wrong: regulation, maturity to scale, down round valuations, slowing of wellness spends, manpower and cost pressures

- What’s going right: newer cross-vertical innovative business models,

Alternative Therapies

Growth and new customer acquisition is the new mantra in 2023 as consumer spending decelerates further. New products and therapies that have accessed funding in 2021are going to find it difficult to raise at the expected valuation. Large MNCs are also entering in this space to fight for the consumer’s mindshare. Funding crunch is going affect growth. Expect an IPO. Some of the players may scale down or shut down due to funding. Consolidation activity will increase.

2023 Outlook: Hot

- What’s going wrong: maturity to scale, consumer education and confidence, clinical research, new product development, growth, funding crunch,

- What’s going right: discretionary consumer spending, newer cross-vertical innovative business models, mainstream complementary treatment.

Let’s wish that we focus on building trust in healthcare for the consumers in 2023 and there is peace across for the world to come out of recessionary trend that would boost the investor confidence across.

Happy investing and stay safe!

Also Listen: