There have been very positive developments for Indian healthcare on the digital front. First, the Indian Telemedicine Guidelines and then the National Digital Health Mission (NDHM). From various think tanks and industry bodies there have been various numbers been project on the incremental value that these will create for the Indian economy. While it is wishful to conjecture the US$ 250 billion dollar impact, what hums in my mind is the Dire Straits famous 14-minutes “Telegraph Road” song. At that time, Mark Knopfler was reading the novel The Growth Of the Soil by the Nobel Prize winning Norwegian author Knut Hamsun and he was inspired to put the two together and write a song about the beginning of the development along Telegraph Road and the changes over the ensuing decades. Using the same analogy, the development of India’s Digital Health Silk Road is feasible on the back of the physical and human healthcare infrastructure. So let’s tune in to my song!

India is a country of paradoxes for healthcare infrastructure. India has 18% of world’s population. However, it has around 18% of world’s diseases burden which is increasing. To service this diseases burden, this increasing disease burden, India has only 2.4% of world’s land mass and needs approx 0.01% of world’s land usage for health and well-being purposes. On the clinical manpower supply, India has 1% of world’s lab techs, 9% of world’s health workers, 8% of world’s nurses and doctors. To level up India to the global average, the total investment is approx $460 billion now (165 countries in the world had a GDP of less than $460 billion in 2018). (see Tedx talks My Presentations – Kapil Khandelwal (KK) To address the country’s healthcare needs within the constraints of capital, land and clinical manpower, homegrown solutions are required. At per capita healthcare spend of INR 4116 (USD 55), India’s per capital spend is growing @ 22% pa. However, India is amongst the lowest 4 countries (ranked 129) in the world on healthcare spend as per Oxfam’s latest Commitment to Reducing Inequality Index 2020 at 4% of GDP (against the globally recommended 15% of GDP).

Let’s set the context under which there has been an accelerated push for healthcare digitization in India. The Great Covid Lockdown. Elective healthcare were down by 70% across the board due to lockdown and priority to Covid affected. The healthcare industry started rumbling and requesting Government to come out with a bail-out package of over INR 50000 crs. Doctors needed to restart their practice through work from home or anywhere. The decade-long deadlock on the telemedicine act between Medical Council of India (MCI) and the Ministry suddenly cleared. There was a mutual agreement to develop the telemedicine road and to regulate the gold rush road to telemedicine in India.

The actual verse of the telemedicine regulations in India was announced by the Niti Aayog and the MCI. The Prime Minister in his verse of Independence Day speech also announced the National Digital Health Mission (NDHM). The draft verse of the digital health regulation was available for the general public to review and critique. This was the back drop to the crescendo of the industry chorus on the digital health in India and the opportunity it offered.

With the regulatory verse out in the public, the industry voice chorus on the real impact to the Indian economy initiated. One industry report estimated the pace of digital healthcare can unlock USD 200 to 250 billion in next 10 years in terms of primary and secondary impact to the nation’s economic value. These value-creation in the march to the wild west will be on three key roads:

- Road 1: From episodic care to wellness-oriented care

- Road 2: From volume-based to value-based healthcare

- Road 3: From siloed systems to streamlined processes

While such stratospheric estimates at a Concorde-neck supersonic speed of the digital health silk road to the Wild West is great for headlines for the chorus, let’s not fool ourselves with the history of what the retail (brick and mortar) and ecommerce underwent in the past decade which went super sonic with investments and valuations on digital retail commerce in India. I have been writing about various issues and roadblocks to digital health path in my various columns which are available at My Library – Kapil Khandelwal (KK)

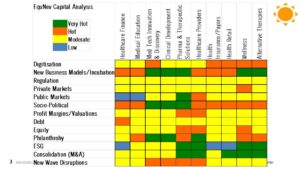

For any song chorus there is also a bridge/solo that makes the real sense. Here is my view of the chorus. The last decade received around USD 500 million in different ventures of digital health which were cut-past healthcare business models of the West. The current technology spend on these is around USD 500 million per annum. For the USD 250 billion impact on the ground to be realized a straight forward deep healthtech investments of around 5% (around USD 12.5 billion) is to be right away with a gestational lag of around 3 years on a conservative 2x on valuations return and not on revenue growth. In other words, all the sum total of early stage VC money raised in 2019 globally will have to be directed to India and that too in healthtech. A tough ask and a pipe dream.

Let’s also focus on the available data sets which is the oil to run the digital health motorway in India that we currently have. Currently, India’s data sets on healthcare is of the Telegraph road era. These include information on radiology, EMR, labs, meds, monitoring, doctor exam, nurse observations, claims data, billing and transactions. This data set is available for the Bharat Stack 1 (the elite-12% of India’s population). The real driver for the growth is the Bharat Stack 2 (the next billion of India’s population) and 30-odd points of healthcare data (not under the current NDHM regulations) which will make the digital health silk road truly a reality. An incremental investments of USD 18 billion in deep tech ventures in next generation digital health ventures to create a true high-speed digital health motorway of the future.

Therefore to land the stratospheric Concorde of the chorus that were singing, we require a total of USD 30 billion of tech investments on the word go. Where is that sort of money? We still don’t know where this money raised will be invested and that is not the point we are belabouring. Taking that cue, we have been tracking around 150 healthtech ventures in our annual healthcare and life sciences investment heatmap on digital. We will need to create 10000s of ventures that can create the depth and width of healthcare apps for the next billion today!

While most songs orchestra fade and end abruptly, this India digital health silk road would need a different Outro to its song. On a conservative basis, we estimated that the overall India digital health silk road opportunity is valued conservatively at USD 50 billion as it currently stands with the different constraints in our physical and technology healthcare delivery system. This is on the back of three key multiplier effect on the Indian healthcare economy:

- Increasing per capita spend on health and well being of the next 1 billion population as disposable incomes goes up moving from the informal sector to formal sector in next 10 years

- Incremental 1/6th disease burden our population carries as compared to world due to the genomic make up and ageing population in next 10 years through alternative healthcare delivery models

- Emerging alternative digital healthcare delivery models that would play on the shortages in the physical delivery system as penetration and acceptance of mobile first delivery of healthcare services become mainstream and productivity of the clinical manpower is augmented by healthtech

Money for Nothing – Covid Vaccines for Free

Another Mark Knopfler hit which talks about the excesses of a rock star and the easy life it brings compared with real work. Between the Independence Day announcement and the Bihar elections manifesto announcement, there seems to be shift in the focus and the priorities it seems from our Rock Star Prime Minister. The Government would not have the funds to spend on the Digital Health Silk Road if it spends its budget on providing free Covid Vaccines to the masses.

Only time will tell how the orchestra and the song of the great India digital health gold rush will play out!

Excerpts of this blog published as an article in VC Circle: