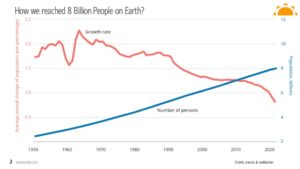

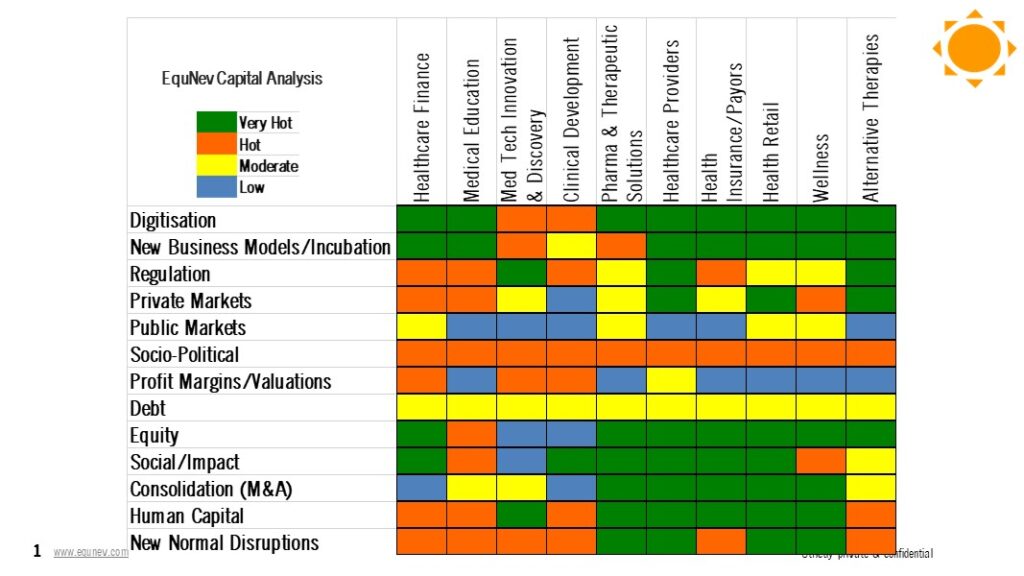

In 2024, the world will be as uncertain, if not more, as it was and anticipating what will happen next is an ever more challenging task for our Algorithms and our teams. Since 2013, our algorithms have been accurately predicting the investment heatmap in the healthcare and life sciences in India which were predicting with 95% accuracy on the sectoral investment cycle in India till the end of 2019. Since the Covid Pandemic in 2020 we lowered levels of prediction accuracy like we started back in 2013. The fake narratives and echo chambers that were peddled during the pandemic years of 2020-22, that vitiated our predictions during the pandemic years continues in for some other factors. 2023 was even more unpredictable in many ways. Our algos do not penetrate the terrorists, government intelligence and security networks and hence unable to consider events that playouts in the Middle East and impacting geopolitics, investments in Indian Healthcare and Life Sciences to some part of the investment flows from offshore. Hence, we have made attempts to analyse International ‘Geo Politics’ as a separate factor and bolt-on-top of our algo predictive models to adjust our heat map for 2024 to accurately predict whether the heat is on in our 2024 Heat Map.

2024: A Year of Geopolitics than Geo Economics

The biggest political event in India in 2024 will be the Lok Sabha General Elections. Hence H1 2024 will not see any major policy or budgetary directions to the sector till the new Government takes over in New Delhi by June 2024 and then presents its budget. For the first time, in the post pandemic era, almost all global funds, analysts and bankers have a unanimous consensus on India’s positive outlook for 2024, some even covering India as a separate chapter in their reports which was dedicated to China in their Asia Outlook till 2022. However, healthcare and life sciences sub sectors in India have its divergence to the overall India outlook for 2024. We have endeavored to bring out the deeper analysis and specifics out of the broad ‘India Positive’ Outlook for 2024 for the Healthcare and Life Sciences Sector in India.

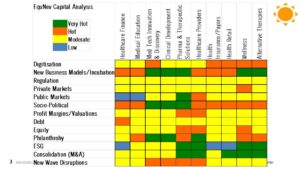

The wave of optimism for 2024 in Indian healthcare and life sciences stems from the following:

- The pace of digitization is now veering toward mainstream adoption of Generative Artificial Intelligence (AI) tools and solutions across that are being piloted.

- New business models/incubation for investments are emerging (see out Future Bets in Healthcare) that will be cross-domain

- The bills and laws introduced in the Parliament in the Session New Healthcare Bills 2023 Archives | Kapil Khandelwal KK are yet to shape bounce in investments.

- Muted returns in the private markets will continue in 2024 as the winter of private investments continues in 2024. Let us understand that the best investments tend to occur during times when investment outlooks appear riskier, so the lower prices in many kinds of equity investments might well yield attractive returns over time.

- Companies listed on the bourses have always underperformed the broader index in the last 2 general elections of 2014 and 2019 by -4.5 to -6.5%. We are expecting the elections results to be neutral this time on the Indian bourses. A few big names to IPO in 2024.

- With one-third of India’s population now constituting Gen Alpha and Gen Z, the health and wellness aspirations of this cohort is the growing aspirational class that wants to live life post Covid-19 differently and different products and services will serve as the next growth opportunity.

- The valuations have come back to realistic levels to the pre-covid levels for primary and secondary investments.

- Debt and equity requirements have stabilised as the cash-crunch situation during the pandemic have ‘normalised’ and so are the return expectations. Both are negatively correlated with yields globally. In other words, investments in equity and its returns will tend to outperform the market, as yields decline.

- As new Generative AI capabilities emerge, the investments in human capital for newer skills are emerging. Also, newer models of ‘sweat’ equity/debt are emerging.

- Investments in newer health and wellness solutions to weather climate change are getting exciting. (see out Future Bets in Healthcare).

- M&A and buyouts are expected to continue, but lower from the peak of 2022.

- How India plays its geopolitics will also determine the quality and quantum of foreign investments in India in the various sub sectors.

The 2024 India Healthcare and Life Sciences Investment Heat Map is as under:

Healthcare Financing

Newer products for financing healthy lifestyle for the Gen Alpha and Gen Z are emerging. Financing ‘idleness’ and healthy entertainment lifestyle through innovative business models are the key. There is a consumer shift for spending on healthy lifestyle which is a personal investment in longevity of healthy life.

- 2024 Outlook: Moderate

- What’s going wrong: slower market/product innovation, right bite for the consumers, reach and penetration to New Gen consumers, financing costs

- What’s going right: India stack digitisation, uberisation, AI solutions

Medical Education

Valuations are correcting and consolidation activity is accelerating. New regulatory regime will come into force and will require investments in managing the delivery and quality of content. New skills for the new AI tools and newer consumer’s requirements needs is accelerating but not in the curriculum.

- Outlook: Moderate

- What’s going wrong: Alignment to new consumers and care, increasing debt burden, new age skills certification, CME with AI-tools

- What’s going right: Skill-mix churn, upgradation of skills, AI for frontline workers

Med Tech Innovation and Life Sciences Discovery and Clinical Development

Capacity creation and new product development continues as India is now into the China+1 club. Expect a few IPOs this year in this sector. Government grant funding will temper down. Geo polities is a key risk to create supply chain disruptions.

- 2024 Outlook: Hot

- What’s going wrong: IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration, PLI policy for sub sector, geo politics, supply chain disruptions

- What’s going right: Human capital, emerging social innovation models, right products selection, market appropriate solution development, peptide based products, chronic diseases product innovation for co morbidities

Pharma and Therapeutic Solutions

Geo politics may affect supply chain and missed topline and profitability estimates. Cost competitiveness like Chinese players to compete globally is the key for growth. Expect a few IPOs, buyouts and exits via secondary sale.

- 2024 Outlook: Moderate

- What’s going wrong: price controls, wrong product portfolio, capacity scale up, global or China-level cost competitiveness, exit of PLI incentives, shortage of skilled workforce

- What’s going right: distribution infrastructure, digital business models, government incentive programs

Healthcare Providers

High levels of leverage is still a concern. Private equity investments slowing down due to valuation expectations. Expect a few IPOs, buyouts and exits via secondary sale. Capacity creation is slowed down due to fund crunch.

- 2024 Outlook: Moderate

- What’s going wrong: margin pressures, price controls, execution of programs on the ground, supply and demand mismatch in micromarkets, debt financing costs, gun powder churn, operating cash runway, liquidity and working capital crunch, not exploring newer formats

- What’s going right: asset-lite models, medical tourism

Healthcare Insurance

Loss ratios and profitability is slowing improving as pricing and products are rationalized. Expect two IPOs of two major players. New products innovation for newer consumer’s requirements is lagging.

- 2024 Outlook: Hot

- What’s going wrong: product fit to consumer needs, product approvals, IPOs pricing and valuation

- What’s going right: Consumer demand, reduced loss ratios

Health Retail

The Pharmacy Bill 2023 brings its own set of challenges. AI pilots once mainstream will reduce costs and margin pressure albeit very slowly. The valuation is still a challenge for raising fund and buy-outs, secondary exits. Expect an IPO.

- 2024 Outlook: Hot

- What’s going wrong: regulation, operating margins, spurious social media channels affecting consumer confidence, health UPI, time to scale

- What’s going right: consolidation, newer cross-vertical innovative business models, profitability focus, AI adoption and models

Wellness

2021 was the highest growth year in the last 10 years on the back of discretionary consumer spending on wellness. Digital business model innovation is still lagging. Medical wellness tourism will be recover in Q3 of 2022. M&A activity and consolidation to continue in 2022 but at a slower pace. Corporate Wellness spends to continue to fuel growth in 2022

- 2024 Outlook: Very Hot

- What’s going wrong: regulation, maturity to scale, new mass market business models, repeat sales, spurious social media channels, fake outcome/claims

- What’s going right: newer cross-vertical innovative business models, corporate wellness spending

Alternative Therapies

New Gen consumers are seeking unique experiences and combing with mental health and rejuvenation as their discretionary spends are increasing.

- 2024 Outlook: Very Hot

- What’s going wrong: maturity to scale, consumer education and confidence, clinical research, new product development, inflated valuation, new mass market business models, repeat sales, spurious social media channels, fake outcome/claims

- What’s going right: discretionary consumer spending, newer cross-vertical innovative business models, mainstream complementary treatment

Moving Forward

As one iconic smart investor said that one should be investing in healthcare and life sciences because you believe smart investing will yield results that are beneficial for society, not just to enrich oneself.

Happy investing and stay strong!