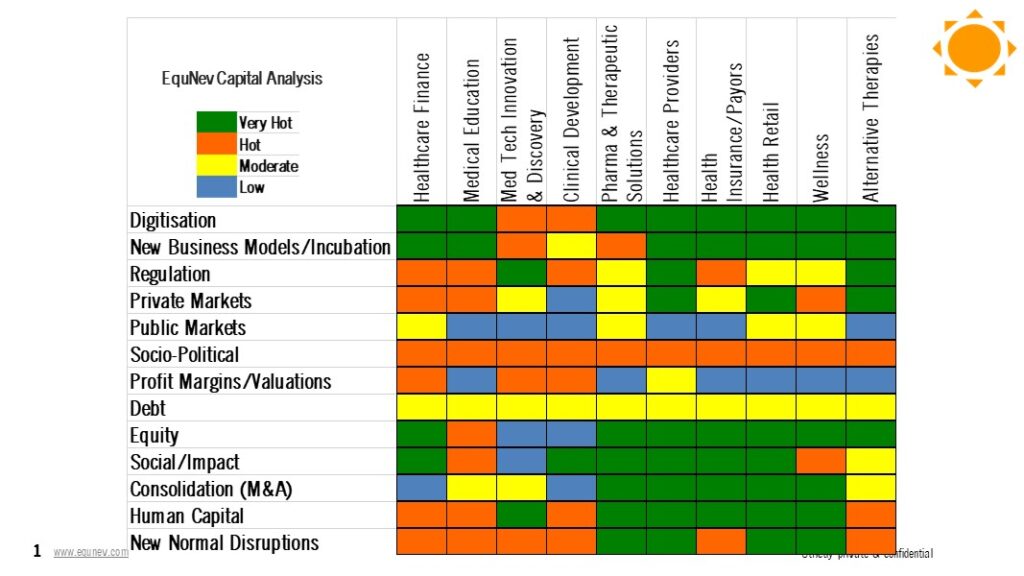

Healthcare and Life Sciences in 2021: Part 1- Sectoral Investments Heat Map

Since 2013 our algos have been accurately predicting the investment heatmap in the healthcare and life sciences in India which were predicting with 95% accuracy on the sectoral investment cycle in India till the end of 2019. Covid Pandemic has completely disrupted and reset the investment cycle in India and we missed out all our prediction accuracy for 2020. We were at cross roads for releasing our Heat Map for 2021. The first was to actually abandon the whole exercise of predicting. The second was to actually relook at India and the world afresh and rebuild out algos and work with lower levels of prediction accuracy like we started back in 2013. We chose the later. While we worked on the Heat Map for 2021, we realized that there were additional variables that would impact investments in 2021 which we have added. These are Human Capital and New Normal Disruptions which would have an impact on how investments and investment activity in healthcare and life sciences in India will pan out in 2021. During 2020, while we were tracking the progress or containment of Covid to an endemic stage in India, we also realized that the execution of the Covid-related measures is in the hands of the States of India given that health is a State subject in our Federal governance structure and different States have demonstrated varying levels of outcomes in healthcare. My blog Sustainability of Digital Health | Kapil Khandelwal (KK) provides this insights. We have taken these into consideration to create for the first time State-wise investment Heat Map under Part 2, Hottest States to Invest for Healthcare and Life Sciences. These have been aggregated into our overall Heat Map here. Please await the release of our Part 2 shortly.

As part of our revised Heat Map for 2020 released in mid-2020, we had predicted a V-shaped recovery for healthcare and lifesciences. March 2020 was the all-time low for the markets and BSE Healthcare Index. By 31 December 2020, the index was at all-time high. With the rapid bounce back of the equity markets, the pricing and returns for healthcare and lifesciences is now not going to be sustainable in 2021, given low cost of debt in India, other supply side challenges, proactive regulations such as Telemedicine Act, National Digital Health Mission (NDHM), PLI Incentives, two leading Covid vaccine candidates.

Vaccine Race and Human Capital to Determine Investment Bounce Back

The investment for the industry for bounce back into the new normal is anywhere estimated to be around INR 120,000 crores a good chunk of this is going to be spent on the vaccination program in India. Our heatmap provides the snapshot of how the investment cycle is gearing up with increased pipeline of deals and investment flows. Markets have already recovered and factored this in their pricing.

Based on the Heat Map 2021, we have updated our revised Heat Map of 2020 published in June 2020 with the addition of Human Capital and New Normal Disruptions. Let’s relook at the board trends for 2021 in terms investment activity and trends.

Healthcare Financing

Pay cuts, job losses, low interest rates, reduced household saving and speed for digitization accelerates the ‘India Stack’ to reach to the consumer faster with innovative consumer financing products. Innovation into financing products and services for consumer financing of healthcare will see a few more players emerge. Many existing players are reworking their value proposition and plan to provide innovative products and services thus increasing coverage in 2021. However, as new demand accelerates, risk underwriting is equally important to avoid delinquency.

- 2021 Outlook: Very Hot

- What’s going wrong: regulation, maturity to scale, right bite for the consumers, reach and penetration, debt financing costs, slower non-discretionary and elective healthcare spend, delaying of healthcare spend

- What’s going right: India stack digitisation, consumer borrowing to spend on non-electives, immediate gratification, reduced household savings supplemented by borrowings

Medical Education

Key shortages of healthcare frontline workers was very apparent during the Covid Crisis and now for the vaccination program. The need for regulatory regime to upskills is still being reworked. Healthcare could be the key job creator. Regulatory reforms are urgently required to push digitization and newer business models for upskilling existing workforce. Many of the debt servicing issues of the sector continue to persist with a few more NCLT/bankruptcy cases. A lot more exits expected and churn in ownership of assets due to consolidation activity.

- 2021 Outlook: Moderate

- What’s going wrong: regulation, corruption, no vision, skill shortages, alignment to new age care, increasing debt burden, new age skills certification, funding dry up

- What’s going right: skill demand, NCLT closures, digitisation

Med Tech Innovation and Life Sciences Discovery and Clinical Development

Focus in 2020 for clinical development had completely pivoted towards Covid vaccines and solutions and of global scale. India-Shinning moment with the two vaccines being awarded the emergency approvals has heightened investor interest in India. Investments will be selective in opportunities for Covid related therapeutic solutions. Social innovation would be the way forward. On the human capital, renewed interest of scientists to return back to India like in 2006-07 outsourcing boom.

- 2021 Outlook: Hot

- What’s going wrong: innovation pipeline, IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration

- What’s going right: Human capital, cost advantage, emerging social innovation models,

Pharma and Therapeutic Solutions

M&A and consolidation activity will spiked up. Digitisation will be a key driver in 2021 and beyond. Some social impact models to counter the bottom of pyramid need gaps are emerging. Will not get mainstream in 2021 as China substitution and supply chain issues need to be resolved urgently inspite of positive policy push.

- 2021 Outlook: Very Hot

- What’s going wrong: price controls, policy log jam, wrong product portfolio, innovation and scale up, global or China-level cost competitiveness

- What’s going right: cost advantage, distribution infrastructure, digital business models, Government incentive programs

Healthcare Providers

Funding and liquidity crisis continue after the lock down. Newer delivery models and hospitals of the future with asset-lite strategy emerge as costs build up and prices remain under pressure. Huge churn in asset ownership and consolidation activity. There will be no major action on PPP front. The telemedicine guidelines accelerate digital business models.

- 2021 Outlook: Hot

- What’s going wrong: margin pressures, price controls, GST slabs rationalization on inputs, execution of programs on the ground, PPP in healthcare, supply and demand mismatch in micromarkets, debt financing costs, gun powder churn, operating cash runway, liquidity and working capital crunch

- What’s going right: Digital business models augmentation, asset-lite models

Healthcare Insurance

Complete liquidity crisis due to moratorium of renewals till October 2020. Innovative models for healthcare payors emerge in India for the middle bulge of India Stack for the middle 500 million that are paying out of pocket. As loss ratios will further mount, insurance rate will go northwards. Innovative products and pricing still a distant reality with the regulator in India. Many of the digital healthcare insurance players have to scale back and reduce their human capital and now need to rebuild in 2021. Don’t expect any IPOs.

- 2021 Outlook: Moderate

- What’s going wrong: margin pressures, product fit to consumer needs, product approvals, loss ratios, slow pace of innovation, operating cash runway, human capital reduction, consumer offtake and demand

- What’s going right: Consumer demand, digitisation

Health Retail

Muted consumer demand and discretionary spending due to reduce disposable income will result in slower growth and GMV pick up. Valuations will be a key issue. Consolidation and acquisitions expected for some to survive and grow. VC and PE interest is still muted and reviving their commitments to those ventures that survived the pandemic situation. Consolidation activity will increase. No serious IPO expected in 2021.

- 2021 Outlook: Moderate

- What’s going wrong: regulation, maturity to scale, slower consumer spending, operating cash runway

- What’s going right: Consolidation, newer cross-vertical innovative business models

Wellness

Discretionary consumer spending on wellness to pick up due to fear of Covid. Mass market moderately priced wellness products and business model innovation is still lagging behind. Post lockdown the growth has not be pre-lockdown due to consumer intertia. However, very innovative business models have emerged for the new normal. Investment activity is yet to pick up in 2021 as most of these ventures are in infancy.

- 2021 Outlook: Moderate

- What’s going wrong: regulation, maturity to scale, new mass market business models

- What’s going right: newer cross-vertical innovative business models, Fit India

Alternative Therapies

The Babas promoting alternative therapies have been coming up with Covid related products and its controversies. MNCs and local businesses have entered in this segment affecting their market share and position. Consumers adoption to accelerate faster as these products become the only choice. In this sub-sector, we are witnessing some very interesting ideas for disruptions in the New Normal these are very much at the seed or angel investing stage.

- 2021 Outlook: Hot

- What’s going wrong: maturity to scale, consumer education and confidence, clinical research, new product development

- What’s going right: discretionary consumer spending, newer cross-vertical innovative business models

Stay Safe and Happy Investing in the rest of 2021!