Background

India is the world’s leading vaccine producer. However, a lot of discussions in the media by the politicians blaming the Center for the shortage of vaccines has been doing the rounds. One politician even went to the length of sharing the ‘formula’ of the vaccine to other so that they can manufacture the vaccines. A lot of the noise on the increased supply has been creating smoke screens and mirrors to deflect the current mismanagement and blame game between the center and the states for the second wave of Covid. India had set up its vaccine strategy which was

- Phase 1: Healthcare and other front-line workers, while gradually opening it up to the 45 plus age group.

- Phase 2: Vaccination for all persons above the age of 18 years from 1st May 2021 under phase 3 of its vaccination

- From 1st May, under a liberalised & accelerated phase, vaccine manufacturers would supply 50% of their monthly released doses to the govt and would be free to supply the remaining 50% doses to the state govts. And in the open market at a pre-declared price. States are empowered to procure additional vaccine doses directly from the manufacturers. So far, many states have placed their orders directly with the manufacturers and most states have decided to provide free doses to adults. That said, vaccination will continue as before in govt vaccination centers, providing free of cost to health care workers, front line workers and all people above 45 years.

In between, Investeq, a leading financial analyst states in its report Vaccine Supply Modelling for India: Supplies set to improve, Foreign Vaccines to make a big difference Vaccinations: Total spend of $8 billion on Covid vaccines for India in 2021: Investec, Health News, ET HealthWorld (indiatimes.com).

Why is this noise and panic been created? First the politicians, then some equity investment analysts and then even some scientific journals like the Lancet have started voicing this issue of shortages of vaccine all-together. Is this a foreign vaccine lobby playing to put pressure on India to buy their vaccine as India is one of the biggest markets that they cannot ignore as demand saturates in the US? The second issue is why should states or their politicians not fund the vaccine costs for their constituencies?

Indian Vaccination Drive versus The World/China

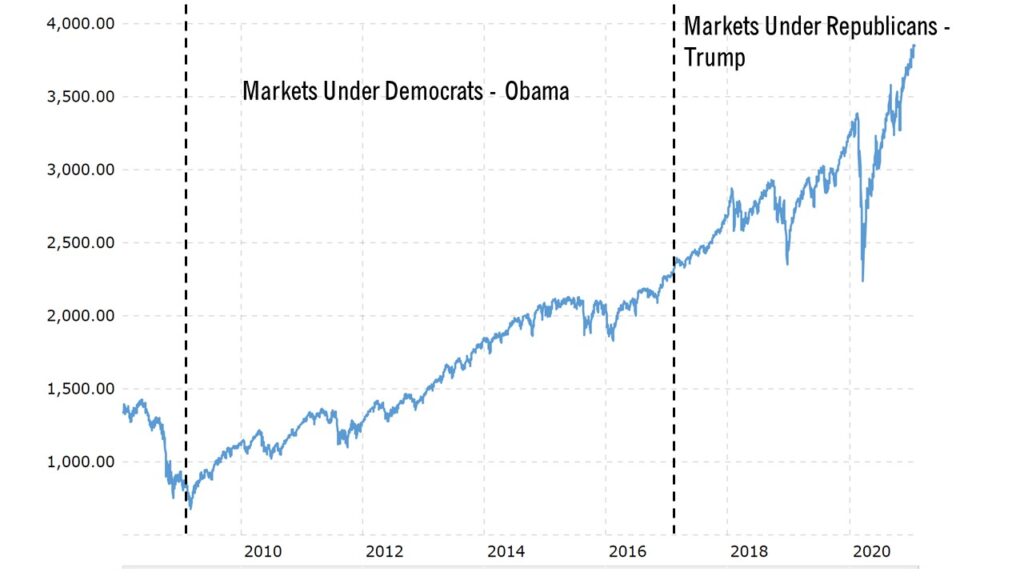

The chart below shows that India has started out early and is better in its vaccination drive than 90 percentile of the countries of the world.

Let’s understand that India is one of the most inhabited countries of the world. Their nearest neighbour China does not even provide information on their immunization status and yet report near zero Covid cases these days. China has procured for only 13% of its population while India 18% of the population so far.

| Country | Vaccine | Amount (USD Mn) | Dosage | Population Covered (Mn) |

| India | AstraZeneca (Covishield) | 417 | 2 | 209 |

| Covaxin | 80 | 2 | 40 | |

| Sputnik V (Russia) | 3.15 | 2 | 2 | |

| Total | 500 Mn | 250 | ||

| China | Sinopharm | 177 | 2 | 89 |

| Sinovac Biotech | 118 | 2 | 59 | |

| CanSinoBIO | 30 | 1 | 30 | |

| Anhui Zhifei Longcom Biopharmaceut | 18 | 3 | 6 | |

| Total | 343 Mn | 183 |

Asking our MPs and MLAs to Pay for the Vaccination

India has already administered 185 million doses. The current split is 166 million of Covishield and 19 million of Covaxin. There are around 315 million doses that has already been paid for. This would cover around 25% of our population. We will need another INR 75,000 crores to fund the immunization program to reach the Covid herd immunity. Now comes the political issue that some of the States want to deliver the vaccine free of costs to all in their states and do not want to pay or have the adequate budgets. Therefore the issue of political blame game between the Center and the States. If you see the current vaccination drive across the districts, some have a higher rate than others. When we dissect the same information as per Parliamentary there is a surprising revelation. Some of the Parliamentary Constituencies has performed better and are not correlated to the district coverage of the immunized population.

So why not decentralize this process of vaccination to the grassroots to the elected MPs and MLAs for their electorate so that all the politics of vaccine supply is nipped in the bid. We have 543 MPs and 4215 MLAs in India. An MP gets INR 5 crores while the MLA get INR 2 crores per annum to be spent on their in their constituency for the local development. This comes to INR 2715 crores per year from Lok Sabha MPs and INR 8430 crores per annum by the State MLAs. Over 5 years this amounts to INR 55725 crores. History shows that hardly 25% of this money is spent. As Covid is a black swarm event for the country, the next 5 years of the MP and MLAs Local Area Development Spend is advanced right now so that they can procure the vaccines for their constituency electorate and get them vaccinated as per the vaccination strategy announced. This will also ensure that the blame game between the parties and the Center and State is put to rest and the elected representative are put to work to deliver the results of the vaccination to their electorates.