Tag: El Toro Finserve LLP

El Toro Finserve LLP

2024 India Healthcare and Lifesciences Investment Heatmap

In 2024, the world will be as uncertain, if not more, as it was and anticipating what will happen next is an ever more challenging task for our Algorithms and our teams. Since 2013, our algorithms have been accurately predicting the investment heatmap in the healthcare and life sciences in India which were predicting with 95% accuracy on the sectoral investment cycle in India till the end of 2019. Since the Covid Pandemic in 2020 we lowered levels of prediction accuracy like we started back in 2013. The fake narratives and echo chambers that were peddled during the pandemic years of 2020-22, that vitiated our predictions during the pandemic years continues in for some other factors. 2023 was even more unpredictable in many ways. Our algos do not penetrate the terrorists, government intelligence and security networks and hence unable to consider events that playouts in the Middle East and impacting geopolitics, investments in Indian Healthcare and Life Sciences to some part of the investment flows from offshore. Hence, we have made attempts to analyse International ‘Geo Politics’ as a separate factor and bolt-on-top of our algo predictive models to adjust our heat map for 2024 to accurately predict whether the heat is on in our 2024 Heat Map.

2024: A Year of Geopolitics than Geo Economics

The biggest political event in India in 2024 will be the Lok Sabha General Elections. Hence H1 2024 will not see any major policy or budgetary directions to the sector till the new Government takes over in New Delhi by June 2024 and then presents its budget. For the first time, in the post pandemic era, almost all global funds, analysts and bankers have a unanimous consensus on India’s positive outlook for 2024, some even covering India as a separate chapter in their reports which was dedicated to China in their Asia Outlook till 2022. However, healthcare and life sciences sub sectors in India have its divergence to the overall India outlook for 2024. We have endeavored to bring out the deeper analysis and specifics out of the broad ‘India Positive’ Outlook for 2024 for the Healthcare and Life Sciences Sector in India.

The wave of optimism for 2024 in Indian healthcare and life sciences stems from the following:

- The pace of digitization is now veering toward mainstream adoption of Generative Artificial Intelligence (AI) tools and solutions across that are being piloted.

- New business models/incubation for investments are emerging (see out Future Bets in Healthcare) that will be cross-domain

- The bills and laws introduced in the Parliament in the Session New Healthcare Bills 2023 Archives | Kapil Khandelwal KK are yet to shape bounce in investments.

- Muted returns in the private markets will continue in 2024 as the winter of private investments continues in 2024. Let us understand that the best investments tend to occur during times when investment outlooks appear riskier, so the lower prices in many kinds of equity investments might well yield attractive returns over time.

- Companies listed on the bourses have always underperformed the broader index in the last 2 general elections of 2014 and 2019 by -4.5 to -6.5%. We are expecting the elections results to be neutral this time on the Indian bourses. A few big names to IPO in 2024.

- With one-third of India’s population now constituting Gen Alpha and Gen Z, the health and wellness aspirations of this cohort is the growing aspirational class that wants to live life post Covid-19 differently and different products and services will serve as the next growth opportunity.

- The valuations have come back to realistic levels to the pre-covid levels for primary and secondary investments.

- Debt and equity requirements have stabilised as the cash-crunch situation during the pandemic have ‘normalised’ and so are the return expectations. Both are negatively correlated with yields globally. In other words, investments in equity and its returns will tend to outperform the market, as yields decline.

- As new Generative AI capabilities emerge, the investments in human capital for newer skills are emerging. Also, newer models of ‘sweat’ equity/debt are emerging.

- Investments in newer health and wellness solutions to weather climate change are getting exciting. (see out Future Bets in Healthcare).

- M&A and buyouts are expected to continue, but lower from the peak of 2022.

- How India plays its geopolitics will also determine the quality and quantum of foreign investments in India in the various sub sectors.

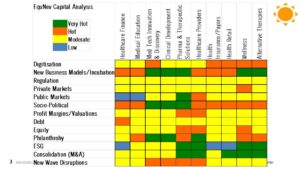

The 2024 India Healthcare and Life Sciences Investment Heat Map is as under:

Healthcare Financing

Newer products for financing healthy lifestyle for the Gen Alpha and Gen Z are emerging. Financing ‘idleness’ and healthy entertainment lifestyle through innovative business models are the key. There is a consumer shift for spending on healthy lifestyle which is a personal investment in longevity of healthy life.

- 2024 Outlook: Moderate

- What’s going wrong: slower market/product innovation, right bite for the consumers, reach and penetration to New Gen consumers, financing costs

- What’s going right: India stack digitisation, uberisation, AI solutions

Medical Education

Valuations are correcting and consolidation activity is accelerating. New regulatory regime will come into force and will require investments in managing the delivery and quality of content. New skills for the new AI tools and newer consumer’s requirements needs is accelerating but not in the curriculum.

- Outlook: Moderate

- What’s going wrong: Alignment to new consumers and care, increasing debt burden, new age skills certification, CME with AI-tools

- What’s going right: Skill-mix churn, upgradation of skills, AI for frontline workers

Med Tech Innovation and Life Sciences Discovery and Clinical Development

Capacity creation and new product development continues as India is now into the China+1 club. Expect a few IPOs this year in this sector. Government grant funding will temper down. Geo polities is a key risk to create supply chain disruptions.

- 2024 Outlook: Hot

- What’s going wrong: IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration, PLI policy for sub sector, geo politics, supply chain disruptions

- What’s going right: Human capital, emerging social innovation models, right products selection, market appropriate solution development, peptide based products, chronic diseases product innovation for co morbidities

Pharma and Therapeutic Solutions

Geo politics may affect supply chain and missed topline and profitability estimates. Cost competitiveness like Chinese players to compete globally is the key for growth. Expect a few IPOs, buyouts and exits via secondary sale.

- 2024 Outlook: Moderate

- What’s going wrong: price controls, wrong product portfolio, capacity scale up, global or China-level cost competitiveness, exit of PLI incentives, shortage of skilled workforce

- What’s going right: distribution infrastructure, digital business models, government incentive programs

Healthcare Providers

High levels of leverage is still a concern. Private equity investments slowing down due to valuation expectations. Expect a few IPOs, buyouts and exits via secondary sale. Capacity creation is slowed down due to fund crunch.

- 2024 Outlook: Moderate

- What’s going wrong: margin pressures, price controls, execution of programs on the ground, supply and demand mismatch in micromarkets, debt financing costs, gun powder churn, operating cash runway, liquidity and working capital crunch, not exploring newer formats

- What’s going right: asset-lite models, medical tourism

Healthcare Insurance

Loss ratios and profitability is slowing improving as pricing and products are rationalized. Expect two IPOs of two major players. New products innovation for newer consumer’s requirements is lagging.

- 2024 Outlook: Hot

- What’s going wrong: product fit to consumer needs, product approvals, IPOs pricing and valuation

- What’s going right: Consumer demand, reduced loss ratios

Health Retail

The Pharmacy Bill 2023 brings its own set of challenges. AI pilots once mainstream will reduce costs and margin pressure albeit very slowly. The valuation is still a challenge for raising fund and buy-outs, secondary exits. Expect an IPO.

- 2024 Outlook: Hot

- What’s going wrong: regulation, operating margins, spurious social media channels affecting consumer confidence, health UPI, time to scale

- What’s going right: consolidation, newer cross-vertical innovative business models, profitability focus, AI adoption and models

Wellness

2021 was the highest growth year in the last 10 years on the back of discretionary consumer spending on wellness. Digital business model innovation is still lagging. Medical wellness tourism will be recover in Q3 of 2022. M&A activity and consolidation to continue in 2022 but at a slower pace. Corporate Wellness spends to continue to fuel growth in 2022

- 2024 Outlook: Very Hot

- What’s going wrong: regulation, maturity to scale, new mass market business models, repeat sales, spurious social media channels, fake outcome/claims

- What’s going right: newer cross-vertical innovative business models, corporate wellness spending

Alternative Therapies

New Gen consumers are seeking unique experiences and combing with mental health and rejuvenation as their discretionary spends are increasing.

- 2024 Outlook: Very Hot

- What’s going wrong: maturity to scale, consumer education and confidence, clinical research, new product development, inflated valuation, new mass market business models, repeat sales, spurious social media channels, fake outcome/claims

- What’s going right: discretionary consumer spending, newer cross-vertical innovative business models, mainstream complementary treatment

Moving Forward

As one iconic smart investor said that one should be investing in healthcare and life sciences because you believe smart investing will yield results that are beneficial for society, not just to enrich oneself.

Happy investing and stay strong!

Also Published in Express Pharma February 2024

2024: Healthcare and Life Sciences Investment OutlookGrowing the Investments in India Tech Stack and New Age Internet and Ecommerce

Podcast

QuoteUnquote with KK and Kevin T Carter, Founder and Chief Investment Officer, EMQQ Global, An Emerging Markets and Indian Exchange Traded Fund (ETF) on NYSE

Also Watch

What is ETFs?

Also Read

The Future of Indian Consumertech

BCG + Matrix Partners - Future of Indian Consumer Tech

Democratising Digital Commerce in India

Living in the Age of Disasters: From Multilateral to Bilateral Aid

Introduction

In July 2013, I wrote an article titled The Business of Disasters in my column (w)Health Check ((W)Health Check | Kapil Khandelwal KK). The idea in the article was to encourage the corporate sector in India to innovate business models to manage disasters. (see the text of the article below). The world in the second decade of the twenty first century has witnessed all the types of disasters conceivably possible that has left behind deaths and devastation. A lot has been spoken and written on biological disaster during and post Covid-19 pandemic. The ability to impact these threats is beyond control of the people and more in the hands of the healthcare systems managed by the relevant Governments around the world. We should now discuss on the Geophysical and Hydro-Metrological Disasters where there is still lack of understanding.

The organizational set up and confidence in the multilateral agencies has definitely been dented. What alternatives does the world have now to face the incoming disasters?

Global Maps of Geophysical and Hydro-Metrological Disasters

The global map of Geophysical and Hydro-Metrological Disasters provides that not the regions around the world are at mortality risk of such disasters.

There are many prediction models available to inform where these disasters will hit next with a fair amount of accuracy. Therefore, unlike biological disasters which are hard to predict before they strike, there is a measure of preparedness that is possible to manage Geophysical and Hydro-Metrological Disasters when they strike. Still the multilateral agencies have not been preparing to meet these eventualities.

Lessons from Recent Disasters

Biological Disaster: Covid 19 Outbreak

During the Covid-19 outbreak, we have witnessed how global multilateral organisations like the World Health Organisation (WHO) were incapable of dealing with the situation that the then US President Donald Trump decided to pull out of the WHO as its major sponsor. Moreover, the manner in which the WHO approved the covid vaccine and its effectiveness is now out. As a result countries like India has to suffer in releasing its vaccine to its own people or supply it globally. Months later release of other countries vaccines, did India supply its more effective vaccine to over 100 countries on bilateral basis. But the delay India faced by WHO for approval of its vaccine lead to flooding of ineffective vaccines.

Geophysical and Hydro-Metrological Disaster

Recently earthquakes and floods which have hit several countries, the multilateral agencies such as International Red Cross were not capable enough to handle the devastation. As a result, many countries have responded to the disaster based on their relations with the devastated country. Turkey earthquake is an example. We still do not know what is going to happen. But major first responders to such countries were on bilateral basis. Here also India responded to Turkey’s request by sending its National Disaster Response Force (NDRF) teams. It’s another issue that Pakistan did not allow Indian aircraft passage through its airspace to reach Turkey faster.

Rise of Bilateralism and Its Risks

Since late 2010s, the financial support received of the member countries to the multilateral countries has been gradually reducing. They have been stretched to maintain their administrative budgets versus funding disaster management operations.

The additional capacity for disaster management which strikes countries in one stroke of nature, lies with other countries in limited measure as multilateral agencies are not adequate enough to handle to situation. These capabilities when aggregated would barely be sufficient to manage the crisis through the disaster. Let’s also understand that bilateral aid and support by other countries is motivated by diplomatic relations and ties. The current Turkey and Syria earthquake demonstrates this vividly. Turkey got the majority of the bilateral aid and support while Syria was not. Another example is the great floods in Pakistan where India’s aid was not requested nor India provided it. Moreover, much of the aid that Pakistanis received was never delivered to the people suffering. This acerbates the plight of the people suffering in these disasters. Therefore geo-political considerations come into play to support disaster management bilaterally. This brings to the point of the risks of rising bilateral flow of disaster management aid, support and services to countries in disaster. Some of these include:

- Bilateral aid and support may come with the strings and expectation of support to the doners by the receivers in international politics, trade and commerce at a later stage

- The aid and support may not be fairly distributed across the political boundaries which are impacted

- Like many aid projects that I have worked in Africa, end abruptly as soon as the crisis is stabilized. The longer-term rehabilitation is not considered in bilateral aid and support. The same may be true in current Turkey-Syria earthquakes.

- These incidents also become an opportunity to debt trap the countries which are financially and economically week. Pakistan is a case in point after the floods to Chinese debt-trap.

- The checker board of international diplomacy in such circumstances may create more tensions for the donors in the future when other countries compare the situation in their own backyard when it had occurred and who stood up to support them bilaterally.

- Political unrest in the donor countries over bilateral support to other countries provided.

Given these risks, would it not be prudent to organize private enterprise business models with innovative financial models to sustain these businesses (see my article below). These were initial thoughts in 2013 by me. But given the frequency of disasters the world and its countries are facing, it become evident that rather than expecting bilateral aid and support, the fully life cycle of disaster management can be managed by private enterprises with full disclosures and accountability. Many ESG and impact funds would definitely invite such ideas of such private enterprises.

Article: The Financials of Disasters

It is time for the corporate sector to take over disaster risk management and disaster medicine in India

Background

Probably the greatest concentration of pilgrims in any region in the world occurs in India’s mountain regions of Himachal Pradesh, Uttaranchal and Uttar Pradesh, where 9.3 million pilgrims each year arrive at the major entry point into the Pahari region. Between 2001 and 2010, the number of visitors to the state rose nearly 200 percent to 30.3 million. Major Hindu shrines located in the state, about 70 percent of the tourists who visit the state visit religious sites. However, last months pilgrim disaster in Uttarakhand with the search and rescue operations for the pilgrims needs to be reviewed. With large-scale politicking, drama and oneupmanship by the political parties in the aftermath of the disaster, requires an assessment on the failure of the government in providing services in such situations and leaves me wondering on the areas where different business models can be operated by the private sector in the health and well being of people in such situations.

| 1. Sequence of a disaster: “befores”, “durings” and “afters”.

2. Triggering events and coupling causes. 3. Large-scale damage to human life and environment. 4. Large economic costs. 5. Large social costs. 6. HOT (human, organizational and technological) and RIP (regulatory, infrastructural and preparedness) factors. 7. Multiple stakeholder involvement and conflict. 8. Immediate and longer-term responses. 9. Crisis resolution attempts. 10. Focus on symptoms not causes. |

What is Disaster and Disaster Medicine?

A disaster is not a “crisis” in the traditional meaning of the word – a situation in which important decisions involving threat and opportunity have to be made in a particularly short time – rather, disasters involve management procedures which must be maintained and management problems coped with under conditions of major technical emergency involving threats of injury and loss of life. (See Box). There are two types of disasters – natural and technological disasters. Natural disasters include three specific groups:

- Hydro-meteorological disasters. Including floods and wave surges, storms, droughts and related disasters (extreme temperatures and forest/scrub fires), and landslides and avalanches.

- Geophysical disasters. Divided into earthquakes and tsunamis and volcanic eruptions.

- Biological disasters. Covering epidemics and insect infestations.

The technological disasters comprise three groups, which are:

- Industrial accidents. Such as chemical spills; collapses of industrial infrastructures; explosions; fires, gas leaks; poisoning; radiation.

- Transport accidents. By air, rail, road or water means of transport.

- Miscellaneous accidents. Collapses of domestic/non-industrial structures; explosions; fires.

The effects of theses disasters can be view on health and well being from five different perspectives. These include:

- preparedness and availability of medical and health facilities, services, personnel and equipment;

- immediate casualties and deaths caused by the disaster;

- secondary illness and deterioration of health conditions following the disaster;

- destruction or damage to medical and health centres and services;

- response capability of the health services and the capacity for post-disaster recovery.

The response to health problems of such magnitude, under adverse and literally catastrophic conditions, cannot be sufficient with mere emergency medicine or just the provision of relief. Disasters, particularly the one in Uttarakhand are not merely very large accidents; they involve complex public health issues and health management problems at a time when the normal coping mechanisms are disrupted or even out of action. In recent years, the health profession has, to this end, developed new approaches and a new discipline now referred to as “disaster medicine”.

| Disaster Medicine is the study and collaborative application of various health specialties – e.g. paediatrics, epidemiology, communicable diseases, nutrition, public health, emergency surgery, military medicine, community care, social medicine, international health – to the prevention, immediate response, humanitarian care and rehabilitation of the health problems arising from disaster, in cooperation with other non-medical disciplines involved in comprehensive disaster management. |

In case of floods like that in Uttarakhand the risks of infectious diseases and of malnutrition are real, and the necessary personnel, medicine and supplies should be geared to those needs.

Different Business Models and Opportunities Addressing Disasters in India:

With the occurrence and intensity of disasters increasing in India, there are several business models that we can look as. This is not an exhaustive assessment of the opportunities, but an initial map that can be used to build on to the same.

Pilgrimage Travel/Health Advisory Services

There is no risk rating and advisory services in India that provides travellers with information in the risk rating at different times of the year or on a general travel situation. There are no personalized services that provide information and questions to pilgrims health, security, medical information such as vaccination requirements, infectious diseases common in destinations, food and water safety, and tips on staying healthy while on pilgrimage. Also there are no travel information on emergency medical and other support services. Private weather forecasting and advisory business models do exists. This can be an extension to their business.

Personalised Emergency Medical Care and Evacuation

Membership based services for providing emergency medical care and evacuation is the need of the hour. The services should include evaluation, airlifting, trauma management from the disaster. The services should be followed by consistent protocols with coordination and rapid. One of the areas where a centralized control room which can co-ordinate with the victims and their family members is an essential part of the service. In case of international pilgrims, the service should provide assistance with passport documentation and visa clearances during emergencies, so that the border transits can be smooth.

Specialised Hospitals near the Disaster Zone

With the intensity of disasters increasing in occurrences, there is an opportunity for setting up small specialized hospitals that can cater to the disasters in a specialized way and can be an extension for the supply chain and logistics to the operations in the disaster zone. These hospitals can provide medical equipment, pharmaceuticals, and medical consumables to remote site support.

Medical College in Disaster Medicine in India

There are several institutes of excellence in India that provide courses and degrees in disaster management. However, like the US where there is a board of disaster medicine with special curriculum and licensure of working professionals in this field of medicine, there is no medical college or National Center of Excellence in India providing UG or PG courses. India can well be served by this branch of specializing doctors from a recognized Center of Excellence in Disaster Medicine.

A Public-Private Corporation for Disaster Risk Management

India is one of the countries that consistently ranks amongst the top-5 countries in the world where most of the disasters strike. The lack of faith in the state government of Uttarakhand by the faithful devotees of other states and independent operations by individual state governments to search, rescue and airlift the victims itself gives rise to the business of disaster risk management that could be outsourced to an independent company by these state governments rather than political oneupmnship! On a serious note, other countries that are as disaster prone as India such as Phillipines have used public-private partnerships to disaster risk management using community participation and consistently reduced disaster risks year on year! This will not only create employment opportunities in the community, but also infrastructure and logistics to handle risk mitigation measures on a real time basis.

Some Interesting Business Models in Place

There are some very interesting business models in place for disaster risk management around the world in operation. Some of the ones that need a mention are as under:

Reuters Alertnet:

AlertNet is a free humanitarian news service run by Thomson Reuters Foundation covering crises worldwide. The award-winning website provides news and information on natural disasters, conflicts, refugees, hunger, diseases and climate change.

International SOS:

International SOS is the world’s leading medical and travel security services company. Their enterprise services help organizations protect their people across the globe. Our teams work night and day from more than 700 locations in 76 countries.

Doctors Without Borders

Médecins Sans Frontières (MSF) is an international medical humanitarian organization created by doctors and journalists in France in 1971. Today, MSF provides independent, impartial assistance in more than 60 countries to people whose survival is threatened by violence, neglect, or catastrophe, primarily due to armed conflict, epidemics, malnutrition, exclusion from health care, or natural disasters. MSF provides independent, impartial assistance to those most in need. MSF also reserves the right to speak out to bring attention to neglected crises, challenge inadequacies or abuse of the aid system, and to advocate for improved medical treatments and protocols. In 1999, MSF received the Nobel Peace Prize.

Reflecting Forward

The events that have unfolded in the face of disasters in India require execution and not politicking. It is time private enterprise take over where Government has failed to deliver just like main stream healthcare to the masses, it is time for taking over Disaster Risk Management and Disaster Medicine in India.

2023 India Healthcare and Lifesciences Investment Outlook

Since 2013 our algos have been accurately predicting the investment heatmap in the healthcare and life sciences in India which were predicting with 95% accuracy on the sectoral investment cycle in India till the end of 2019. Since the Covid Pandemic in 2020 we lowered levels of prediction accuracy like we started back in 2013. Covid-19 pandemic killed over 23 million people globally. 2022 has brought new headwinds, some we haven’t seen in over 40 years. Healthcare spending will fall in 2023 in real terms, given high inflation and slow economic growth, forcing difficult decisions on how to provide care. Digitalisation of the healthcare system will continue, but the use of health data will come under stricter regulation. A New world order under the current geo politics fragmentation and multilateral world is bringing India to the forefront. It’s vaccine diplomacy, effective and cost-effective therapeutic solutions is a game changer for India.

2023: A Year of Newer Normal

Since the Great Chinese famine of 1959, for the first-time life expectancy as per UN, Covid-19 had been cut by 1.7 years off global life expectancy, reducing it to 71.1 years. While a recovery probably began in 2022, the UN calculates that 2023 will be the year when life expectancy first exceeds 2019 levels. The investment thesis with most of the investment managers in the current scenario is more of a long view on healthcare infra which are less tied to economic cycles and an imminent slow down globally. Some of the investment risks the healthcare and lifesciences sector faces include rising real interest rates, increasing price inflation for healthcare products and services in the face of weakening in consumer spending, reshoring the supply chains and the wars, both trade and terriotorial. Digital businesses are equally going to be impacted. ESG and impact funding is waiting for deployment.

Let’s relook at the board trends for 2023 in terms investment activity and trends.

Healthcare Financing

2021 was an all time-high for healthcare financing sector due to emergency and non-discretionary spend on healthcare. Health Tourism related funding is only going to take off in Q3 after the current wave tides down. Consolidation activity to slow down.

2023 Outlook: Moderate

- What’s going wrong: right bite for the consumers, reach and penetration, higher debt financing costs, slower non-discretionary and elective healthcare spend, delaying of healthcare spend and health tourism, new wave restrictions, shortage of digital workforce

- What’s going right: India stack digitisation, agetech, consumer borrowing to spend on electives

Medical Education

Skilled manpower shortages is the key driver for growth. All the students who have returned back from Ukraine need to be accommodate in our current system Regulatory reforms are urgently required to push digitization and newer business models for upskilling existing workforce. Churn in ownership of assets due to consolidation activity will continues at a faster pace.

2023 Outlook: Moderate

- What’s going wrong: regulation, corruption, no vision, skill shortages, alignment to new age care, increasing debt burden

- What’s going right: skill demand, digitisation, manpower-led business models creating their own content or tying up with larger established players, cross-border students coming to India, export of clinical manpower to the West

Med Tech Innovation and Life Sciences Discovery and Clinical Development

India has proven to be the vaccine supplier to the world in 2022 with over forty percent of the world’s pre-qualified vaccine products are made in India. Capacity creation and new product development need to be accelerated particularly in infectious diseases and some niche segments. Reshoring and government policies for that need to be accelerated. Global investment and partnerships is on the rise in 2023. Patent expiry of some of the blockbusters in the US are a huge opportunity.

2023 Outlook: Moderate

- What’s going wrong: Innovation pipeline, IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration, global collaboration and partnerships

- What’s going right: Human capital, cost advantage, reshoring the supply chain, Make in India

Pharma and Therapeutic Solutions

Several players are going to go for the IPOs in 2023. Reshoring the supply chain is moving slowly. The Government production linked incentive is not moving as intended in the medtech, intermediates, APIs. The capital expenditure in creating world-class green infra is still to take off.

2023 Outlook: Hot

- What’s going wrong: price controls, policy log jam, innovation and scale up, cost competitiveness, exit of PLI incentives, scale of capex, Margins pressure, IPO valuation

- What’s going right: cost advantage, distribution infrastructure, Government incentive programs, blockbuster going off patent in the US, ESG funding entry

Healthcare Providers

2022 was a negative year for almost all the listed stocks. With higher interest rates, funding costs for have increased. Inputs such as steel, cement, etc, have also shot up increasing the capex per bed. Newer sources of funding green healthcare infra as a long-term bet which are less tied to economic cycles is emerging. Digitalisation will slow down even further as consumers go back to the old ways. Costs and profitability pressure will increase to maintain the investor interest. PE valuations will continue to get right adjusted to market valuation.

2023 Outlook: Moderate

- What’s going wrong: margin pressures, price controls, execution of programs on the ground, PPP in healthcare, supply and demand mismatch in micromarkets, debt financing costs, gun powder churn, operating cash runway, liquidity and working capital crunch

- What’s going right: Asset-lite models, demographics

Healthcare Insurance

The IPOs in 2021 in the sector have created uncertainty in valuation and investor sentiment. The sector will continue to grow as it did in 2022. New products and customer segmentation is going to be the growth drivers

2023 Outlook: Hot

- What’s going wrong: product fit to consumer needs, product approvals, loss ratios, operating cash runway, human capital reduction, consumer offtake and demand, IPOs pricing and valuation

- What’s going right: Consumer demand, digitisation, new products

Health Retail

Spends on healthcare are slowing down and so is the discretionary spend. Falling service levels and consumer trusts is at an all-time high. Costs and margin pressures is going to be more acute. Only one major IPO expected in 2023. Many of the late stage start-up are going to scale down or not raise the capital at the expected valuations.

2023 Outlook: Moderate

- What’s going wrong: regulation, consolidation, slower consumer spending, funding drying up, operating cash runway,

- What’s going right: Consolidation, newer cross-vertical innovative business models, profitability focus and valuation being right adjusted

Wellness

Growth which tapered down in 2022 is still going to be sluggish in 2023 as consumers cut back their spends. Digital business model innovation is still lagging behind. Medical wellness tourism will be recover in Q3 of 2023. Corporate Wellness spends which also scale down even further. PE funding is going to slow down even further as valuations squeeze even downwards with margin pressure. Expect one major IPO here.

2023 Outlook: Hot

- What’s going wrong: regulation, maturity to scale, down round valuations, slowing of wellness spends, manpower and cost pressures

- What’s going right: newer cross-vertical innovative business models,

Alternative Therapies

Growth and new customer acquisition is the new mantra in 2023 as consumer spending decelerates further. New products and therapies that have accessed funding in 2021are going to find it difficult to raise at the expected valuation. Large MNCs are also entering in this space to fight for the consumer’s mindshare. Funding crunch is going affect growth. Expect an IPO. Some of the players may scale down or shut down due to funding. Consolidation activity will increase.

2023 Outlook: Hot

- What’s going wrong: maturity to scale, consumer education and confidence, clinical research, new product development, growth, funding crunch,

- What’s going right: discretionary consumer spending, newer cross-vertical innovative business models, mainstream complementary treatment.

Let’s wish that we focus on building trust in healthcare for the consumers in 2023 and there is peace across for the world to come out of recessionary trend that would boost the investor confidence across.

Happy investing and stay safe!

Also Listen:

What’s Next? Operation Himalaya?

Preamble

Operation Ganga was an evacuation operation by the Government of India to evacuate the Indian citizens amidst the 2022 Russian invasion of Ukraine, who had crossed over to neighboring countries. This involved transport assistance from the neighboring countries of Romania, Hungary, Poland, Moldova, Slovakia to reach India. Over 20,000 medical students were evacuated in Operation Ganga. I have been writing and talking about it over the last 10 years. Let me outline the magnitude of the situation at hand. India constitutes ~18% of world’s population. From here things become a bit trickier. We have world’s 21% disease burden. ie. One-sixth higher proportion of people falling sick. On the clinical manpower shortages, we just have around 8% of the total global labour force of doctors, nurses and healthcare workers to address the 20% of the global disease burden we carry with our people. We are short by 5 lakh doctors, 20 lakh nurses and 30 lakh short of other health workers. Fortunately, we are a net exporter of nurses to the world so we have to also back fill the gaps of nurses leaving out of India for those remaining in India. Coming to the capital to address these gaps, we require close to Rs 30 lakh crores or $430 billion to come to the global average of hospital beds. Another Rs 2 lakh crores or $29 billion is required to build capacity for healthcare manpower. Therefore the total investment is approx $460 billion. To give you the magnitude, 165 countries in the world had a GDP of less than $460 billion in 2018. Given the shortage of merit quota seats in Indian medical colleges, students have to migrate abroad for pursuing their medical education. We need an upstream Operations Himalaya in earnest.

Vision for Operations Himalaya

There is a saying “9 men cannot make a baby in 1 month”. Similarly, students enrolled into medicine today will add incrementally to the workforce in next 4 years. The silver lining is that this capacity building spend would lead to $1.45 trillion of additional incremental to the GDP after 5 years as 1 incremental bed capacity creates 28 jobs over its lifetime. In other words healthcare economy in India as a standalone would itself be #16 nation in terms of GDP. The table outlines the future of Medical Education.

| What is the Future of Medical Education? As per the Milbanks Report on the Future of Academic Medicine 2025, there are 3 key trends that are impacting medical education Digitalization of Healthcare new science and technology, particularly genetics and IT speed of internet and digitalization unimportance of distances 24/7 society lack of agreement on where healthcare begins and ends Personalization of Healthcare rich and poor gap seeking “wellness” and rise of self-care & sophistication increasing anxiety about security and ethical issues emergent diseases Globalization of Healthcare gap between what can be done and what can be afforded increasing accountability of all institutions loss of respect for experts (more so after the pandemic) economic and political rise of India and China |

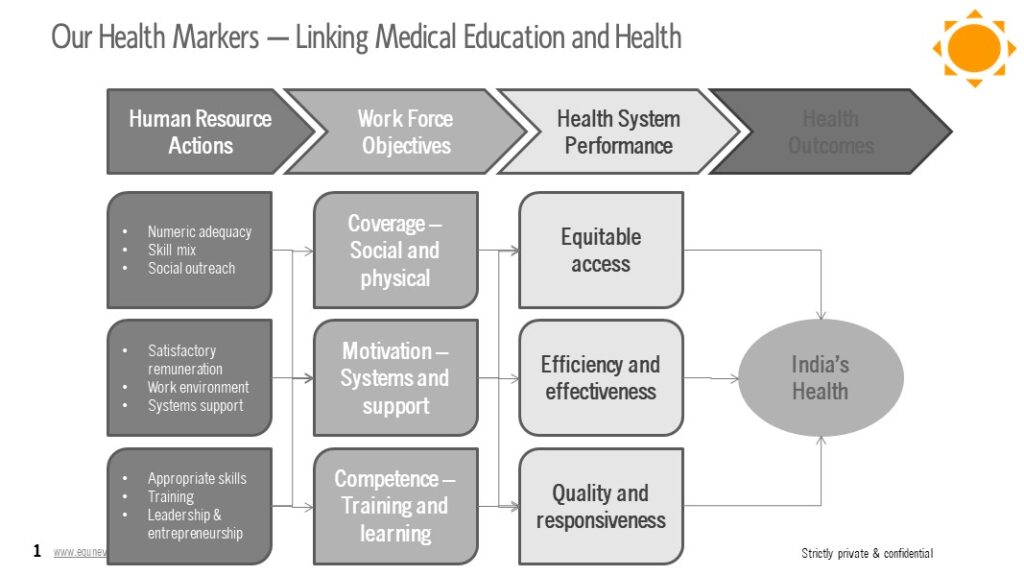

There needs to be a top-down vision for expanding the supply of clinical manpower in India which needs to be tied to the healthcare outcomes our healthcare system needs to achieve. The following framework which I presented earlier outlines the process for setting up the vision.

In the past I have defined these as the 3 A’s.

- Affordability: The Cost and Benefits of Developing Careers in Healthcare in India

- Accessibility: Providing trained staff in different parts of India

- Assurance: Training to medical professionals meets global standards to perform in any healthcare system

Key Issues: Healthcare Manpower Economics:

It costs approximately Rs 2 crores per seat to set up a medical college for 100 seats in India. While this may be economical, investments in medical colleges and doctor training is a lengthy process; therefore, changes implemented to alter supply do not have immediate effects on the supply of trained healthcare professionals. A recent estimate reveals that as many as 40% of rural posting by trained medical graduates and post graduates in different states in India are not fulfilled. There is a huge shortage of gynaecologists, cardiologists and child specialists in rural hospitals in the government sectors. Hence the government announcement to increase the supply of medical graduates may still not address the accessibility issue. We may end up importing clinical manpower from lower cost destinations if we are not able to produce these cost effectively in India.

Medical education is supposed to be overseen by the different Councils of India, which is responsible for ensuring the quality of both the infrastructure and the professors at India’s medical institutes and also provide assurance that they meet the global standards. Since demand is high, it is difficult for schools to retain faculty over the long term, which creates a lack of continuity in both the school’s practices and its policy. The plethora of new and underequipped medical schools will create more doctors and healthcare professionals on paper, but will lower the quality of the doctors produced, further exacerbating the preexisting shortage. So, while attempting to alleviate a shortage of doctors, India has managed to create a completely new crisis on top of the preexisting one – the shortage of teaching professionals in these medical collages. Various estimates put this somewhere between 75,000 to 100,000 trained teachers and professions currently.

Finally,

Mere policy announcement for opening up more medical colleges in India is not the panacea for solving the shortages in the supply of healthcare professionals and the people to train healthcare professionals. It is time we look at the issues holistically and plan for the future by going upstream towards the Himalaya from the current emergency evacuation of Operation Ganga!

Also Read Article published in my Column – A Dose of IT published in Deccan Chronicle and Asian Age – 14 February 2011

Rs 1 Crore crores Human Capital Impact – A Generation Lost

My presentation at the 21st World Quality Congress a fortnight ago just highlighted the human capital impact due to healthcare and education in India. A whopping Rs 92,28,230 crores to the Indian economy at net present value! This is like creating over 1500 TCS or Infosys or Wipro in today’s size overnight in our economy.

Let us understand, although India has 18% of world’s student population that is the largest in the world, its policy and direction on higher education, including medical and health sciences sector is not clearly articulated towards inclusive development. Regulation, size of funding to this sector, both public and private is one of the key determinants of India’s ability to generate wealth (GDP). Moreover sectorial priorities and directions in sectors such as health sciences, infrastructure if not clearly addressed could create future crisis in the economy and further impede economic growth.

On the demand side, we already know that India contributes to 18% of world’s population, however its share of world’s disease burden is 20%. Hence to treat the increased disease burden, India requires incremental human capital of doctors, nurses and other health workers. But the issues get very grave for India. We have around 8% of world’s doctors, nurses and health workers. Hence we may have to create more human capital in healthcare to treat India’s disease burden. What’s more, of the Rs 490,000 crores we currently require for skills repair to make the current human capital coming out of our colleges and universities, approximately 25% of this is to the medical and nursing schools make the graduate doctors, nurses and health workers job ready.

On the supply side, there are competing careers options and sectors that await the aspirants that are entering the colleges and universities to take up courses. Using the Lev and Schwartz model for human capital valuation, we evaluated the value of different careers in health sciences versus other sectors. What is interesting is that a nurse who decides to work in India human capital value would be Rs 19 lakhs while a surgeons with a master’s degree is around Rs 1 crore. Other non medical sectors are equally attractive in terms of their human capital value. Hence the issue for India is how do we make this attractive for aspirants to take up medicine as a career. While shortage in supply of doctors, nurses and health workers in the economy will obviously push up their human capital value, knowing the disease burden of India. However, we will lose a whole generation of boomers!

But all is not lost for India. Our enrolment ratio in higher education is 12% and is half of China’s at 24% of all students passing out of secondary schools. Hence even to match China’s enrollment, we would create a total human capital of Rs 1 Crore crores using the same valuation model at higher education level. To meet this potential, we need to be opening over 25 colleges everyday for the next 3 years in the brick and mortar world!

We will again fail to create such huge capacity in the real brick and mortar world as we have under supplied the infrastructure sector due to the boom in other sector in the last decade. Hence the only option left behind for the present generation to graduate through higher education is through ICT (online) world. Over the last 5 years there have been many ventures that have come forward looking at the wider opportunity in the ICT space for medical education. However the key barriers have been the regulatory and accreditation agencies that have slowed down the mass adoption.

It is time that we wake up to the huge human capital potential awaiting India. If we fail to deliver, we not only diminish this human capital over Rs 1 Crore crores, but the increased disease burden that I wrote about in my earlier column would cost us over Rs 25,00,000 crores of diminished human capital potential!

It’s all about the quality of human capital we produce and how we produce it that will matter for this generation that is passing us in India. This is the biggest scam that none of our future generations in India will forgive us as Indians.

Budget 2022: When is Healthcare’s Amrit Kaal Coming?

Preamble

On 1 February 2022, our Hon. Finance Minister presented her fourth budget in the Parliament and introduced the “Amrit Kaal” in Point 4 of her speech, “we are marking Azadi ka Amrit Mahotsav, and have entered into Amrit Kaal, the 25-year-long leadup to India@100. Hon’ble Prime Minister in his Independence Day address had set-out the vision for India@100.”

Point 5 of the Budget Speech outlined the vision for Amrit Kaal, “By achieving certain goals during the Amrit Kaal, the government aims to attain the vision. They are:

- Complementing the macro-economic level growth focus with a micro-economic level all-inclusive welfare focus,

- Promoting digital economy & fintech, technology enabled development, energy transition, and climate action, and

- Relying on virtuous cycle starting from private investment with public capital investment helping to crowd-in private investment.

The Finance Minister has envisioned to develop ‘sunrise opportunities’ such as artificial intelligence, genomics, and pharmaceuticals to assist sustainable development and modernise the country. However, this is more on the supply side industrial development. But the core issue of healthcare infrastructure is not addressed. Envisioning the Indian population which we would like to be a healthy one by 2047 when we enter India@100. I believe that Budget 2022 missed out a huge opportunity in envisioning Healthcare 2047! Here are my reasons.

Current Undergoing Transformation in Healthcare

The country has undergone a tough time during the pandemic. The Government has played its enabling role in ensuring the supply chain disruptions with China does not lead into a health crisis of sorts. On the other hand, the funding of Covid-Vaccine and immunization has ensured that the country emerges quickly into an endemic phase of Covid pandemic. While this was going on, there was strengthening and upgrade of the digital health infrastructure. The pandemic has also taught lessons to the private healthcare delivery ecosystem to restructure their business models and ensure that there is a push toward lower costs healthcare delivery models. These transformations have demonstrated India’s resilience in its healthcare systems to face emergency situations like the current pandemic.

India’s Amrit Kaal’s Population Demographics

As the chart below demonstrates that India’s population by 2047 will be shifting towards middle age bulge. Over 300 million (~19% of the total population) will be senior citizens by 2047. Our dependency ratio will be around 40%. These 40% will be in the tax paying bracket which will provide the then Finance Minister in 2047 the revenues to spend for different welfare programs including healthcare.

Lessons from Elsewhere in the World

In early 2000, I was involved in restructuring the healthcare systems of Saudi Aramco. Being the largest oil producer in the world, the company had been underfunding the pension and healthcare benefits of their employees who were going to be retiring in the future. The financing of these healthcare benefits created a financial crisis of sorts which have to be funded.

USA has also being facing such challenges when its baby boomers have now become unproductive senior citizens and their total healthcare bill is currently 18% of their GDP.

Vision for India’s Amrit Kaal Healthcare Delivery to Avoid Maha Kaal

As per current estimates, our country requires USD 400 billion of investments in healthcare infrastructure on our current demography to meet the global norms. There are no allocation in the current National Infrastructure Pipeline (NIP) funding for healthcare. Therefore much of the investment will be private sector driven in the future for healthcare infrastructure.

Such experiences elsewhere in the world remind me that our Amrit Kaal in 2047 does not end up as Maha Kaal of our Amrit Kaal where we would have to look up to Indian Gods who were invoked to end the situation. There have been several demands in the last few budget to accord infrastructure status to the healthcare industry. The current budgetary allocations to healthcare all though increasing has not been sufficient to build capital formation for healthcare infrastructure in the country. From the current 2.5% of GDP, there needs to broaden the spend on healthcare. We need the real picture of the input and outputs in healthcare. With the current GST regime of zero tax on healthcare services, we are not able to gather the real value of healthcare in the country and healthcare should be under minimum GST slab so that there is pass through benefits of the inputs that are set off. This will lead to a lot of transparency and provide real hard estimates of healthcare spend of the country.

Assuming by 2047 our dependency ratio will be lower than today. Which means that the total taxpaying population in 2047 may be same as today or even lower. There needs to be a plan to ensure that current taxes from the current population who will become senior citizens by 2047 will be underfunded like in the examples that I have mentioned below, leading into a budgetary crisis.

In all earnest, given the current constraints the current budget 2022 could do so much for healthcare. But now that the Amrit Kaal is out of the bag, there needs adequate focus to healthcare to avoid healthcare Maha Kaal in 2047 when we enter India@100.

2022: Healthcare and Life Sciences Investment Outlook

Since 2013 our algos have been accurately predicting the investment heatmap in the healthcare and life sciences in India which were predicting with 95% accuracy on the sectoral investment cycle in India till the end of 2019. Since the Covid Pandemic in 2020 we lowered levels of prediction accuracy like we started back in 2013. While we worked on the Heat Map for 2022, we realized that every new wave of Covid is like a black swan event and raises the uncertainty and reduces the accuracy of the predictions with a reset. For 2021, we released two sets of heat maps, one for the healthcare and life sciences sub sectors and another for the States. Since the Central Government took the mantle of immunization, the need for updating state-wise heat map for 2022 is not relevant and not much data is being updated except for the electioneering noise and promises by political parties and immunization achieved.

2022: A Year of Consolidation and Tempering Expectations

2021 was the record year since 2013 when we started tracking the healthcare and lifesciences investments. The investments across the board was the highest, with the maximum number of IPOs and M&A activity, with over USD 2.2 Bn in funding across all the sectors in 2021. Some of the investment activity we predicted for 2022 preponed to 2021 due to positive investor and market sentiments and uncertainty of the future waves of Covid. Therefore, 2022 is a year of consolidation and tempering the tempo of investments.

Let’s relook at the board trends for 2022 in terms investment activity and trends.

Healthcare Financing

2021 was an all time-high for healthcare financing sector. However, recent clamp down of Chinese funded consumer financing fintechs is going to temper down the healthcare financing sector. Health Tourism related funding is only going to take off in Q3. Consolidation activity to slow down.

- 2022 Outlook: Hot

- What’s going wrong: regulation clamp down, right bite for the consumers, reach and penetration, higher debt financing costs, slower non-discretionary and elective healthcare spend, delaying of healthcare spend and health tourism, new wave restrictions, shortage of digital workforce

- What’s going right: India stack digitisation, consumer borrowing to spend on non-electives, immediate gratification, reduced household savings supplemented by borrowings

Medical Education

Key shortages of healthcare frontline workers was very apparent during 2021 Covid Crisis. The need for regulatory regime to upskills is still being reworked. Healthcare could be the key job creator. Regulatory reforms are urgently required to push digitization and newer business models for upskilling existing workforce. Churn in ownership of assets due to consolidation activity will continue albeit at a slower pace.

- 2022 Outlook: Hot

- What’s going wrong: regulation, corruption, no vision, skill shortages, alignment to new age care, increasing debt burden, new age skills certification, funding dry up

- What’s going right: skill demand, digitisation

Med Tech Innovation and Life Sciences Discovery and Clinical Development

India has proven to be the vaccine supplier to the world in 2022. Capacity creation and new product development will continue. Dependence on Chinese supply chain will reduce further as alternatives are developed indigenously. Expect a few IPOs this year in this sector. Government grant funding will temper down.

- 2022 Outlook: Hot

- What’s going wrong: innovation pipeline, IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration, Government grants and funding slow down

- What’s going right: Human capital, cost advantage, emerging social innovation models, lower dependence on Chinese supply chain

Pharma and Therapeutic Solutions

M&A and consolidation activity was at a record high since 2016. Shortage of digital workers will slow down the digital transformation activity. As China substitution and supply chain threats mitigate, the Government will temper down their PLI support as well

- 2022 Outlook: Hot

- What’s going wrong: price controls, policy log jam, wrong product portfolio, innovation and scale up, global or China-level cost competitiveness, exit of PLI incentives, shortage of skilled digital workforce

- What’s going right: cost advantage, distribution infrastructure, digital business models, Government incentive programs

Healthcare Providers

Funding costs will zoom up and will make access to long-term capital dearer. Huge churn in asset ownership and consolidation activity will continue. Digital transformation activity will slow down due to skill shortages

- 2022 Outlook: Moderate

- What’s going wrong: margin pressures, price controls, GST slabs rationalization on inputs, execution of programs on the ground, PPP in healthcare, supply and demand mismatch in micromarkets, debt financing costs, gun powder churn, operating cash runway, liquidity and working capital crunch

- What’s going right: Digital business models augmentation, asset-lite models

Healthcare Insurance

The IPOs in 2021 in the sector have created uncertainty in valuation and investor sentiment. The sector will continue to grow as it did in 2021. Digital push and intermediation will be the key to growth.

- 2022 Outlook: Hot

- What’s going wrong: product fit to consumer needs, product approvals, loss ratios, operating cash runway, human capital reduction, consumer offtake and demand, IPOs pricing and valuation

- What’s going right: Consumer demand, digitisation

Health Retail

The major consolidation of the health retail after hectic M&A activity of 2021 will slow down the decibel levels of consumer discounts and offers to focus on generating healthy bottom lines. Only one major IPO expected in 2022.

- 2022 Outlook: Moderate

- What’s going wrong: regulation, consolidation, slower consumer spending, excess funding for GMV and operating cash runway

- What’s going right: Consolidation, newer cross-vertical innovative business models, profitability focus

Wellness

2021 was the highest growth year in the last 10 years on the back of discretionary consumer spending on wellness. Digital business model innovation is still lagging behind. Medical wellness tourism will be recover in Q3 of 2022. M&A activity and consolidation to continue in 2022 but at a slower pace. Corporate Wellness spends to continue to fuel growth in 2022

- 2022 Outlook: Very hot

- What’s going wrong: regulation, maturity to scale, new mass market business models

- What’s going right: newer cross-vertical innovative business models, corporate wellness spending

Alternative Therapies

Newer products and therapies that have accessed funding in 2021 will continue to fuel growth and investments. Adoption of alternative therapies into mainstream allopathic as complementary treatment is going to accelerate. Newer product development and business models is the key to sustained growth and success in 2022

- 2022 Outlook: Hot

- What’s going wrong: maturity to scale, consumer education and confidence, clinical research, new product development, inflated valuation, over capitalization and cash burn to gain market share

- What’s going right: discretionary consumer spending, newer cross-vertical innovative business models, mainstream complementary treatment.

Let’s wish that there are no further variants and waves in 2022 for any black swarm events for affecting investor sentiments.

Happy investing and stay safe!

Kapil Khandelwal is Managing Partner of Toro Finserve LLP, India’s First Healthcare Infrastructure Fund and Director EquNev Capital Pvt Ltd.

The Oracle Returns

Background

On December 20, 2021, Oracle Corporation and Cerner Corporation jointly announced an agreement for Oracle to acquire Cerner through an all-cash tender offer for $95.00 per share, or approximately $28.3 billion in equity value. Cerner is a leading provider of digital information systems used within hospitals and health systems to enable medical professionals to deliver better healthcare to individual patients and communities.

My Tryst with Cerner and Oracle Along with My Journey

Cerner has been a leader in the health information systems since it was founded as PGI & Associates (after its three founders Patterson, Gorup and Illig) who quit their jobs from Accenture (then Arthur Andersen) in 1980s. I had the chance to work closely with Neil Patterson when Cerner expanded outside of US in Gulf region with the implementation at Saudi Aramco (now Saudi Aramco-John Hopkins) in early 2000s.

During the same time, I had worked with Oracle leadership in the Gulf region on several roll outs in the Government sector.

In early 2000s, Saudi Aramco, world’s largest producer of crude oil was migrating from mainframe environment and had embarked on world’s largest big bang implementation of SAP and corporate performance improvement program in the world. To migrate and manage its in-house healthcare delivery to its employees, contractors and their dependents in Kingdom of Saudi Arabia (KSA) and overseas, the choice was between SAP Healthcare and Cerner. Neil Patterson, the co-founder of Cerner made multiple visits to Dharan, the headquarters of Saudi Aramco to pitch and win the first major implementation overseas. That’s was the beginning of my personal friendship with Neil. As Neil would visit Dharan on quarterly steering body meetings, we would share a quiet dinner and discuss his vision about Cerner and his international growth initiatives before he boarded his private jet to Kansas City. Over the years, Cerner witnessed major growth outside of the US, including some inorganic growth acquisitions like Siemens HMIS and starting their offshore development centers in Bangalore, the largest base after Kansas City. Unfortunately, Neil succumbed to cancer in 2017. I lost a fantastic friend and mentor forever who had guided me in my career at different points in time.

While at KPMG Consulting in the Gulf, I made several bids with Oracle to the various governments in the Gulf. Oracle was great with their database and their product architecture; their major issue was that they lack clinical prowess to manage healthcare either in hospitals or with state healthcare. It was around this time that I was associated with Sam Rao who was Head of Business Development and Large Deals at Oracle. Although, he understood healthcare, but the product deficiencies of Oracle was just not a great fit for running eHealthcare initiatives for the population of GCC countries. Later Sam and I collaborated to start out XY Clinics (an innovative nutri-genomics and diagnostics venture) in GCC and India and had a great run and exit

Flash forward: Many of Cerner and Oracle leadership in the US and Rest of the world either worked with me or had been a partner with me on some of the healthcare initiatives. One of them being Dr John Glassier who I also invited on my podcast QuoteUnQuote With KK.

How Cerner Acquisition Helps Oracle and Vice-versa

Oracle has always had a weak presence in the clinical healthcare information management system. Although it has a great rooster of clients not only in the us but around the world. A mega-29 billion dollar deal will signal that Larry Ellison, Oracle’s founder is serious about getting a big leap into the healthcare sector once again. Its earlier acquisitions in healthcare were small and somewhere did not change Oracle in its ways of doing business with healthcare clients. Therefore Oracle Returns. In the post-pandemic era, as healthcare providers and Government healthcare systems, step up to spend more on their digital and clinical transformation, Oracle-Cerner would definitely be a very strong option. I am informed from my ex-colleagues and industry insiders that Cerner will be kept as a dedicated business unit within Oracle. This would be a very positive development both for Cerner and Oracle as independence of Cerner in the larger Oracle would be a critical success factor for this acquisition. As for Cerner, Neil vision and dream of taking Cerner globally as a leading healthcare information systems player will come true posthumously.

Wishing Oracle and Cerner All the Very Best in their combined journey!

That’s Lazer Sharp Vision, Literally!

Background

Perfect human sight is the greatest gift that a man can get. Years ago, I remember on one of my Rotary Eye Camps in a village near Bangalore, an old lady came to the Eye Camp with the help of her assistant holding her and guiding her to take the steps due to poor vision. The doctors checked her eyes and gave her a pair of spectacles. On wearing the spectacles the lady was overjoyed and filled with tears. She could see perfectly which she had not for years. Her dependency on others and quality of life improved immediately. This incident bought emotional tears to all the people around her. Like the old lady, there are millions of Indians who have poor quality of life due to lack of proper sight as they cannot afford proper spectacles to correct their sight. I seem to be amongst the more fortunate ones who can afford the luxury of sight correction.

My Issues with Hypermetropia, Myopia and Presbyopia

As far as I am concerned, I have always tried to maintain my eyes inspite of long-distance sight (hypermetropia) correction from my teenage years. As I aged (presbyopia), the complexity of near-distance (myopia) reading and long-distance sight have emerged. My lenses that Essilor fitted to combine both of these into one lens in a spectacle resulted in near catastrophe while driving on the highway. As a result I preferred to maintain two sets of spectacle for hypermetropia and myopia. With presbyopia, I have to fit new lenses as the vision for hypermetropia and myopia keep changing. This means a new set of spectacles every year or so to maintain proper vision.

My Experience This Time Getting Vision Correction on Digital

Every year, I visit the optometrist around the festive season to get my vision tested and procure new set of spectacles and lenses as per the advise of the optometrist. Given the lock down situation, I thought of procuring the spectacles through the digital online platforms like Myntra, LensKart, Titan Eye and Amazon, etc rather than shopping for at the physical optician stores. I wanted to try out Lenskart as my daughter had bought two pairs of spectacle recently and was a very loyal customer of them. While all the catalogues of Myntra, Titan Eye and Amazon offered just the spectacles, Lenskart offer the spectacles and a zero-powered bluecut and anti-glare computer lenses fitted along with it. Similar spectacle designs on platforms other than Lenskart turned out to be cheaper as Lenskart was loading the price to the lenses additional. I needed powered lenses to be fitted at an additional cost and throw away the lenses already fitted with Lenskart spectacles.

My WhatsApp Interaction and Talk with Amit Chaudhary of Lenskart

Pissed off with the experience, I WhatsApp Amit Chaudhary, Founder of Lenskart. That’s when I realized the business model of Lenskart versus other digital and brick and mortar opticians out there. Here are some of the excerpts of my telephonic conversation with him

- Lenskart is the largest AR eyewear venture in the world

- Over USD 150 mil of eyewear is sold by them through their platform and lenses are manufactured and fitted through their fully-automated robotic facility

- AR technology and fully-integrated robotic manufacturing facility makes them the cheapest provider of eye wear in the world due to the scale

- They are targeting a total addressable market of around 1.5 billion eyes in India

- They are therefore integrated to provide the full solution of spectacles and lenses as operationally there are challenges of product warranty when customers buy spectacles from them and fit the lenses outside at a local opticians.

There is a stand out quotes that while talking with Amit that summarized their business model

“We are the Maruti of the eye wear business. Customers like you form the top 10% who are the Ferrari’s who would like spectacles not only for functional, but for esteem value”

I like the lazer sharp vision of Amit. As entrepreneurs like him who raise lot of VC and PE capital at some time want to dominate and move away from their core business model and value proposition in the pressure for growth, profitability and valuations.

Although Amit offered to service me as an exception, but that is not core to their way of working. Consumers sometimes miss out on this and crib and bad mouth the start ups on social media, missing out how these start ups are making the world better by offering sight to millions by being cheaper, better and faster. Remined me of the old lady in tears who could see properly and so did I on Amit’s perspective.

Kudos to such start ups which are bringing in technology and production techniques to reach scale!