Mankind versus ChatGPT: Our Caveat for 2025

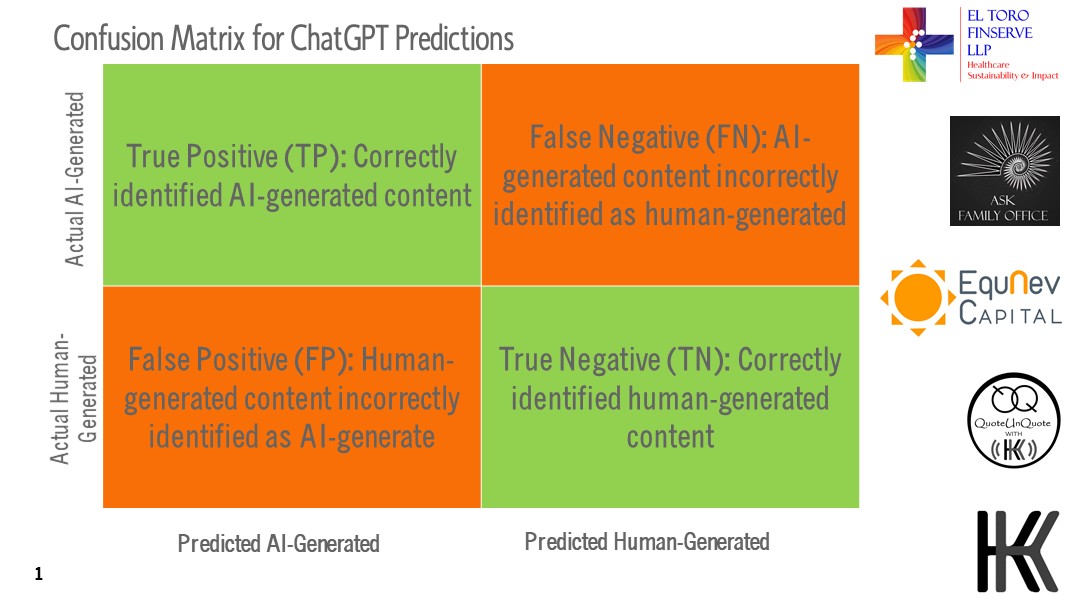

For the first time in AI’s and mankind’s history, the line between what is human and what is AI-driven technology is increasingly blurring, we are witnessing that ChatGPT and other OpenAI models, can influence the rates of false negatives and false positives in various healthcare and investment applications including algorithms that make investment calls based on future predictions. We have been making annual healthcare and life sciences investment predictions since 2013 with 95% accuracy except during the Covid pandemic years. It seems that ChatGPT itself is turning out to be a black swan event for the algorithms which are predicting the future so accurately in the past. As ChatGPT becomes mainstream, we need to understand the “Confusion Matrix” (see chart below) that will ensure with the power of AI and ChatGPT versus the humans in the future as more and more AI-generated content and analytics proliferates the world in 2025 and beyond.

As industries including, Healthcare and Lifesciences is adopting AI very rapidly for delivering healthcare and so do the Banking and Financial Services, investment managers using AI-driven algos for investment calls. We would need to take cognizant of the False Negatives and False Positive that would elevate the risks and mitigate accordingly. We have included AI as one of the factors in our 2025 Outlook, India Healthcare and Lifesciences Investment Heatmap.

2025: Heal the World – From Geo Politics to Socio Politics

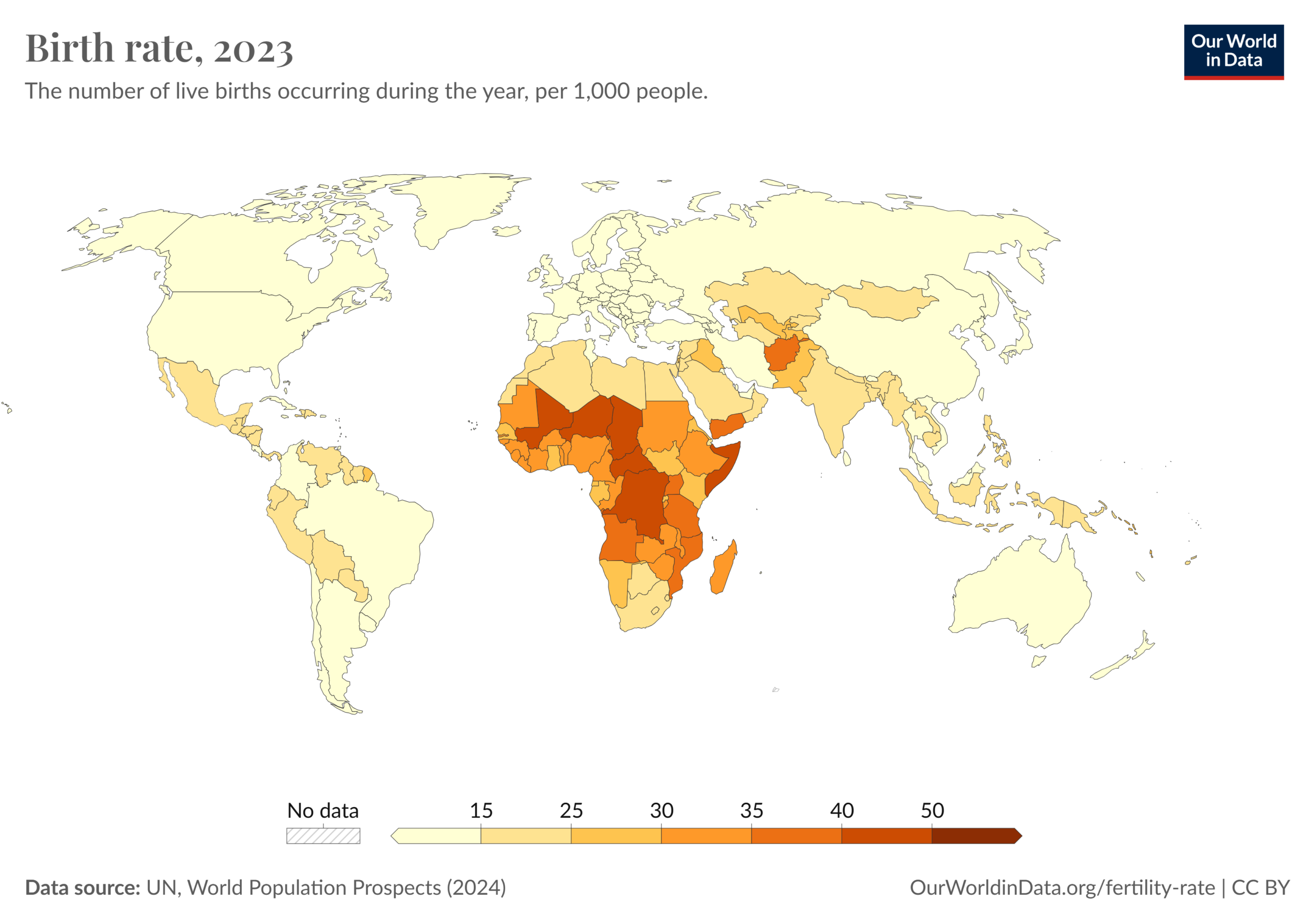

In our 2024 forecast last year we included Geopolitics for the first time in our investment heatmap as the signals were emerging as early as mid-2023. While 2024 witnessed global geopolitics upheaval with regime changes through democratic elections and other means with over 60 wars and armed conflicts ongoing around the world, we were seeing signals of slowdown in growth and investments in Q12024 itself. As a result, as we exited 2024, the growth and investment climate slowed down significantly.

The broad global theme for 2025 is “Heal the World” for better outlook for 2026 and beyond. If we are able to heal the world with robust socio political agenda it would turn out to be the future prosperity of mankind.

2025: India’s Healthcare and Lifesciences Innovation and Business Models

India was also not insulated with the global geopolitics impact. In 2024, there was ~50% decline in capex and investments in the sector. We expect 2025 to continue to be a weak year for investments in the sector. After our general elections, there were uncertainties in our region and further slowing of investment and capex cycles on the back of global slowdown. Healthcare is a big creator of employment and it should not slow down any further in 2025.

Since Q12024, the signals were towards robust investments in early stage innovations and growth in new age business models which we have been labelling as “cross-domain” investment ideas. In March 2024, we released 2024 – India Healthcare And Life Sciences Investment Manifesto | Kapil Khandelwal KK covering key 40 bets that will be an opportunity to invest in the sector that will witness an upside beyond the market returns for the sector over the next 5 years. This will accelerate the investments that was with USD 857 million in 2024 to reach a unicorn status of over USD 1 billion in 2025. Fortunately, this is the only segment witnessing positive growth in investments in 2024 and continues to attract robust growth and investments.

Hence, we have made attempts to analyse International ‘Geo Politics’ as a separate factor and bolt-on-top of our algo predictive models to adjust our heat map for 2024 to accurately predict whether the heat is on in our 2025 Investment Heat Map.

The wave of optimism for 2025 in Indian healthcare and life sciences stems from the following:

- Over half of Indian consumers are increasingly curious to understand their body and well-being by ‘listening to their body’. Innovators and start ups are exploring this opportunity to scale up their ventures.

- Many of the start-ups of the Pre Covid India Stack in healthcare are either pivoting to including AI tech or will perish as AI goes turbo. We are expecting around 450 such start ups at this stage of AI upgrade.

- Agentic AI effectively turbocharges the Do It For Me (DIFM) healthcare economy. Early adopters include GenZ and Millennials (approx 50% of Indians) users who will have their own bots or AI agents helping them choose products and execute transactions in adoption of healthcare products and services as the line between what is human and what is technology will be blurring. Competition will tick-up as starts-ups grow.

- “AI for All is not All” as consumers are getting more consumerised for their health needs. AI cannot solve it all for all of Indian consumers healthcare needs. These include Gen X and Seniors (approx 44% of Indians) are skeptics and late adopters. This innovative products to serve these cohorts is key.

- New business models/incubation for investments are emerging (see our 40 Future Bets in Healthcare 2024 – India Healthcare And Life Sciences Investment Manifesto | Kapil Khandelwal KK) that are cross-domain and will be a potential USD 50 billion addition to India’s GPD in next 5 years.

- Healthcare real estate will also explore cross-domain concepts to fit consumer needs.

- Wellness is now an ‘Avatar’ that is experiential and connects with other lifestyle domains such as beauty, cosmetics, travel, tourism, hospitality, food, technology, wearables tech, work environment and many more. Holistic innovation in experiential longevity is emerging.

- Alternative therapies are now body rejuvenation biohacks that traditional and alternative medicine and wellness cannot provide or fulfill completely and which health fascism fuels. Indian GenZ and Millennials are leading this change.

- New age innovative medical integrative DIFM models will be a push for medical and wellness tourism repositioning for India medical tourism.

- In 2024, the BSE Healthcare Index was one of the standout performers, delivering an impressive 40% year-to-date (YTD) return. This trend continues in 2025.

- The valuations have come back to realistic levels to peak by 2026-27.

- Private hospitals are now aggressively embarking on increasing bed capacity after a phase of consolidation in 2024.

- M&A and buyouts are expected to continue to be buoyant.

- Healthcare real estate are expected to launch and kick off innovative cross-domain formats.

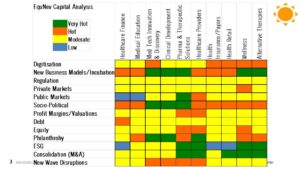

The 2025 India Healthcare and Life Sciences Investment Heat Map is as under:

Healthcare Financing

With mental health needs and healthcare fascism at its peak, newer products and services for financing longevity and healthy lifestyle for the Gen Alpha and Gen Z are emerging. Cross domain models of business are emerging to address the needs to finance consumers needs to such emerging products and services.

2025 Outlook: Moderate

- What may go wrong: false claims by online influencers, right pricing, reach and penetration to consumers, improper lifestyle based consumer segmentation, business volatility in some NBFCs, newer regulations on consumer credits by RBI, lower consumer spending and financing, outstanding credit cards debt

- What’s going right: AI intervention and solutions, lower interest rates,

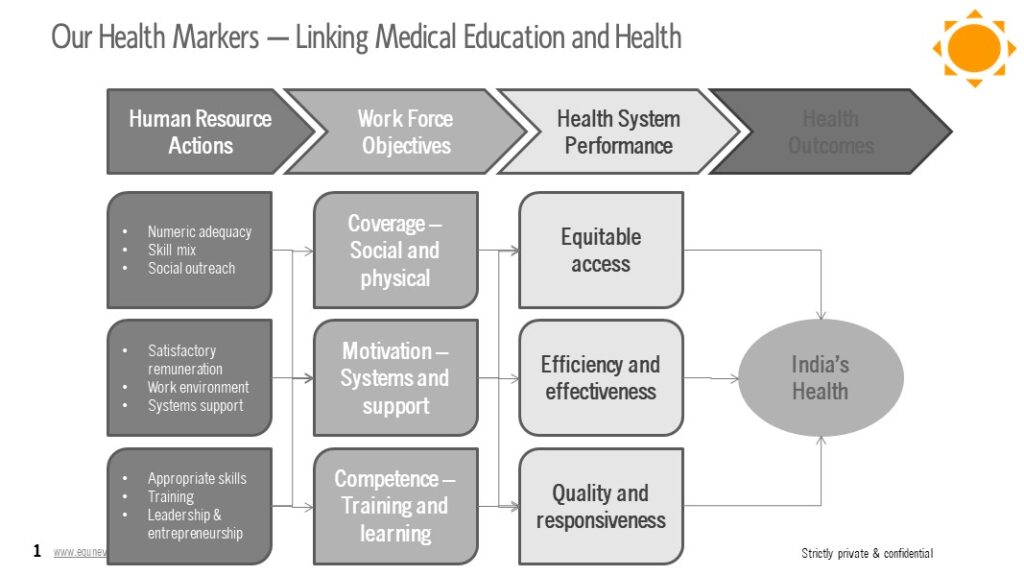

Medical Education

Medical education content is no longer the marker for better valuation and funding. The market has flipped to buyers’ market. The investors are no longer entering into opportunities at the current valuations and will lead to rerating downwards. Need major reforms in the medical education sector.

2025 Outlook: Low

- What may go wrong: lower student enrollment, regulatory issues, new emerging careers in industry, accreditation and learning models, international players and competition

- What’s going right: AI-generated content creation, immersive content, stable valuations

Med Tech Innovation and Life Sciences Discovery and Clinical Development

Trump Administration and the US BioSecure Act will be a positive. India has to enter the big league of biologics with global partnerships as Chinese firms will face headwinds. Cross domain innovation with AI is the key to leapfrog in the global race. Also India needs to reinforce its success in Covid vaccine development to reignite confidence in India. Expect a major IPO.

2025 Outlook: Moderate

- What may go wrong: over dependence on Chinese players, slower reverse brain drain transition of drug hunters from US, low qualified life sciences professionals pool, lower grant funding, no further sops in the 2025 finance budget

- What may go right: emerging social innovation models, market appropriate solution development, native AI models

Pharma and Therapeutic Solutions

Volume growth in the domestic markets, US generics price erosion, with the softening of input costs, ongoing decoupling of supply chain with China and currency depreciation to continue in 2025, will improve the margins very marginally. The companies with strong cash positions will increase capex and also buyouts and M&A activity. Not any major name IPOs expected.

2025 Outlook: Moderate

- What may go wrong: Slower China decoupling of supply chain, continuing US generics markets prices decline, potential increase in tariffs by the US under Trump regime, increased APIs prices, continuing domestic market volume degrowth, no further sops in the 2025 finance budget

- What may go right: US BioSecure Act to favour India, increased R&D spend, new products pipeline, newer capex cycles, multi-year high in US active drug shortages

Healthcare Providers

Capacity creation will now be around 2500 beds in tier 2 and 3 cities. Funding cycles improve as internal accurals improve for fresh capex and capacity expansions and inorganic expansions. Expect a few IPOs, buyouts and exits via secondary sale.

2025 Outlook: Hot

- What may go wrong: margin pressures, supply and demand mismatch in micromarkets, lower medical tourists arrivals, rising valuations, stable margins

- What may go right: asset-lite models, launching into new medical tourism markets

Healthcare Insurance

Payors are seeing insurance penetration grow since the Covid pandemic. Newer markets in the GenZ and Millennials cohorts and geographically tier-2 and 3 cities are the essential for growth. Bundled products and services for health and wellbeing is the key. AI modelling will assist in accurate underwriting of risks. Agentic AI entry to change the solicitation and selling customised bundled products.

2025 Outlook: Hot

- What may go wrong: bundled product for consumer needs, product approvals, risk mitigation for new products, consumers need for longevity, agentic AI to connect consumers, payors and providers for seamless services

- What may go right: Consumer demand, reduced loss ratios, AI fraud detecting agents

Health Retail

Anti-digital trend is catching up with consumers expecting analogic human to human touch for consuming healthcare products and services in cross-domain settings which is now perceived aspirational and desirable. Many digital business models need to tweak their phydigital presence mix. Its back to innovative traditional health retail settings.

2025 Outlook: Hot

- What may go wrong: failing to provide the human to human touch points, talent for new age health retail settings, anti-digital pivoting, wrong business model assumptions

- What may go right: exits in failed business models, profitability focus, phydigital presence

Wellness

The past wellness definition is no longer relevant. New age ‘Gen-Z’ed wellness business models and innovation is emerging which brings in the cross-domain experiential products and services. Redefinition of wellness is the key and will show case the future winners. These innovations will fuel India’s new age wellness tourism too.

2024 Outlook: Hot

- What may go wrong: regulation, talent and skills in cross domain products and services, micro market segmentation, faster beta testing, new mass market business models, spurious social media channels, fake outcome/claims

- What may go right: Gen Z micro segmentation, wearables, biosensors, newer phydigital formats

Alternative Therapies

Redefined by cross-domain influences, emerging tech, wearables, biosensors, cutting-edge innovation in life sciences with other domains fueled by GenZ experimentation with new biohacking and health fascism expressions. It is going to be the next destination of value care in healthcare emerging from real need and experience of consumers for Do It For Me (DIFM) healthcare.

2025 Outlook: Hot

- What’s going wrong: regulations, consumer education and confidence, clinical research, new product development, new mass market business models, repeat sales, spurious social media channels, fake outcome/claims, wrong Gen Z role models, developing phydigital formats

- What may go right: discretionary consumer spending, newer cross-vertical innovative business models, mainstream complementary treatment, wearables, biosensors

Moving Forward

2025 will be a pivoting year for mankind, healthcare and investing as AI for All is not All.

Happy investing and stay strong!

Media Coverage

M&A, Buyouts in Healthcare to Remain Coverage in VC Circle

M&A, Buyouts in Healthcare to Remain Coverage in VC Circle

2025 India Healthcare and LifeSciences Investment Outlook Coverage in Express Pharma Feb 2025

2025 India Healthcare and LifeSciences Investment Outlook Coverage in Express Pharma Feb 2025