Introduction

In July 2013, I wrote an article titled The Business of Disasters in my column (w)Health Check ((W)Health Check | Kapil Khandelwal KK). The idea in the article was to encourage the corporate sector in India to innovate business models to manage disasters. (see the text of the article below). The world in the second decade of the twenty first century has witnessed all the types of disasters conceivably possible that has left behind deaths and devastation. A lot has been spoken and written on biological disaster during and post Covid-19 pandemic. The ability to impact these threats is beyond control of the people and more in the hands of the healthcare systems managed by the relevant Governments around the world. We should now discuss on the Geophysical and Hydro-Metrological Disasters where there is still lack of understanding.

The organizational set up and confidence in the multilateral agencies has definitely been dented. What alternatives does the world have now to face the incoming disasters?

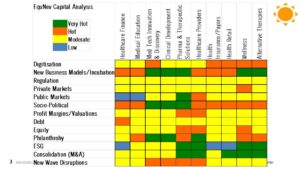

Global Maps of Geophysical and Hydro-Metrological Disasters

The global map of Geophysical and Hydro-Metrological Disasters provides that not the regions around the world are at mortality risk of such disasters.

There are many prediction models available to inform where these disasters will hit next with a fair amount of accuracy. Therefore, unlike biological disasters which are hard to predict before they strike, there is a measure of preparedness that is possible to manage Geophysical and Hydro-Metrological Disasters when they strike. Still the multilateral agencies have not been preparing to meet these eventualities.

Lessons from Recent Disasters

Biological Disaster: Covid 19 Outbreak

During the Covid-19 outbreak, we have witnessed how global multilateral organisations like the World Health Organisation (WHO) were incapable of dealing with the situation that the then US President Donald Trump decided to pull out of the WHO as its major sponsor. Moreover, the manner in which the WHO approved the covid vaccine and its effectiveness is now out. As a result countries like India has to suffer in releasing its vaccine to its own people or supply it globally. Months later release of other countries vaccines, did India supply its more effective vaccine to over 100 countries on bilateral basis. But the delay India faced by WHO for approval of its vaccine lead to flooding of ineffective vaccines.

Geophysical and Hydro-Metrological Disaster

Recently earthquakes and floods which have hit several countries, the multilateral agencies such as International Red Cross were not capable enough to handle the devastation. As a result, many countries have responded to the disaster based on their relations with the devastated country. Turkey earthquake is an example. We still do not know what is going to happen. But major first responders to such countries were on bilateral basis. Here also India responded to Turkey’s request by sending its National Disaster Response Force (NDRF) teams. It’s another issue that Pakistan did not allow Indian aircraft passage through its airspace to reach Turkey faster.

Rise of Bilateralism and Its Risks

Since late 2010s, the financial support received of the member countries to the multilateral countries has been gradually reducing. They have been stretched to maintain their administrative budgets versus funding disaster management operations.

The additional capacity for disaster management which strikes countries in one stroke of nature, lies with other countries in limited measure as multilateral agencies are not adequate enough to handle to situation. These capabilities when aggregated would barely be sufficient to manage the crisis through the disaster. Let’s also understand that bilateral aid and support by other countries is motivated by diplomatic relations and ties. The current Turkey and Syria earthquake demonstrates this vividly. Turkey got the majority of the bilateral aid and support while Syria was not. Another example is the great floods in Pakistan where India’s aid was not requested nor India provided it. Moreover, much of the aid that Pakistanis received was never delivered to the people suffering. This acerbates the plight of the people suffering in these disasters. Therefore geo-political considerations come into play to support disaster management bilaterally. This brings to the point of the risks of rising bilateral flow of disaster management aid, support and services to countries in disaster. Some of these include:

- Bilateral aid and support may come with the strings and expectation of support to the doners by the receivers in international politics, trade and commerce at a later stage

- The aid and support may not be fairly distributed across the political boundaries which are impacted

- Like many aid projects that I have worked in Africa, end abruptly as soon as the crisis is stabilized. The longer-term rehabilitation is not considered in bilateral aid and support. The same may be true in current Turkey-Syria earthquakes.

- These incidents also become an opportunity to debt trap the countries which are financially and economically week. Pakistan is a case in point after the floods to Chinese debt-trap.

- The checker board of international diplomacy in such circumstances may create more tensions for the donors in the future when other countries compare the situation in their own backyard when it had occurred and who stood up to support them bilaterally.

- Political unrest in the donor countries over bilateral support to other countries provided.

Given these risks, would it not be prudent to organize private enterprise business models with innovative financial models to sustain these businesses (see my article below). These were initial thoughts in 2013 by me. But given the frequency of disasters the world and its countries are facing, it become evident that rather than expecting bilateral aid and support, the fully life cycle of disaster management can be managed by private enterprises with full disclosures and accountability. Many ESG and impact funds would definitely invite such ideas of such private enterprises.

Article: The Financials of Disasters

It is time for the corporate sector to take over disaster risk management and disaster medicine in India

Background

Probably the greatest concentration of pilgrims in any region in the world occurs in India’s mountain regions of Himachal Pradesh, Uttaranchal and Uttar Pradesh, where 9.3 million pilgrims each year arrive at the major entry point into the Pahari region. Between 2001 and 2010, the number of visitors to the state rose nearly 200 percent to 30.3 million. Major Hindu shrines located in the state, about 70 percent of the tourists who visit the state visit religious sites. However, last months pilgrim disaster in Uttarakhand with the search and rescue operations for the pilgrims needs to be reviewed. With large-scale politicking, drama and oneupmanship by the political parties in the aftermath of the disaster, requires an assessment on the failure of the government in providing services in such situations and leaves me wondering on the areas where different business models can be operated by the private sector in the health and well being of people in such situations.

| 1. Sequence of a disaster: “befores”, “durings” and “afters”.

2. Triggering events and coupling causes. 3. Large-scale damage to human life and environment. 4. Large economic costs. 5. Large social costs. 6. HOT (human, organizational and technological) and RIP (regulatory, infrastructural and preparedness) factors. 7. Multiple stakeholder involvement and conflict. 8. Immediate and longer-term responses. 9. Crisis resolution attempts. 10. Focus on symptoms not causes. |

What is Disaster and Disaster Medicine?

A disaster is not a “crisis” in the traditional meaning of the word – a situation in which important decisions involving threat and opportunity have to be made in a particularly short time – rather, disasters involve management procedures which must be maintained and management problems coped with under conditions of major technical emergency involving threats of injury and loss of life. (See Box). There are two types of disasters – natural and technological disasters. Natural disasters include three specific groups:

- Hydro-meteorological disasters. Including floods and wave surges, storms, droughts and related disasters (extreme temperatures and forest/scrub fires), and landslides and avalanches.

- Geophysical disasters. Divided into earthquakes and tsunamis and volcanic eruptions.

- Biological disasters. Covering epidemics and insect infestations.

The technological disasters comprise three groups, which are:

- Industrial accidents. Such as chemical spills; collapses of industrial infrastructures; explosions; fires, gas leaks; poisoning; radiation.

- Transport accidents. By air, rail, road or water means of transport.

- Miscellaneous accidents. Collapses of domestic/non-industrial structures; explosions; fires.

The effects of theses disasters can be view on health and well being from five different perspectives. These include:

- preparedness and availability of medical and health facilities, services, personnel and equipment;

- immediate casualties and deaths caused by the disaster;

- secondary illness and deterioration of health conditions following the disaster;

- destruction or damage to medical and health centres and services;

- response capability of the health services and the capacity for post-disaster recovery.

The response to health problems of such magnitude, under adverse and literally catastrophic conditions, cannot be sufficient with mere emergency medicine or just the provision of relief. Disasters, particularly the one in Uttarakhand are not merely very large accidents; they involve complex public health issues and health management problems at a time when the normal coping mechanisms are disrupted or even out of action. In recent years, the health profession has, to this end, developed new approaches and a new discipline now referred to as “disaster medicine”.

| Disaster Medicine is the study and collaborative application of various health specialties – e.g. paediatrics, epidemiology, communicable diseases, nutrition, public health, emergency surgery, military medicine, community care, social medicine, international health – to the prevention, immediate response, humanitarian care and rehabilitation of the health problems arising from disaster, in cooperation with other non-medical disciplines involved in comprehensive disaster management. |

In case of floods like that in Uttarakhand the risks of infectious diseases and of malnutrition are real, and the necessary personnel, medicine and supplies should be geared to those needs.

Different Business Models and Opportunities Addressing Disasters in India:

With the occurrence and intensity of disasters increasing in India, there are several business models that we can look as. This is not an exhaustive assessment of the opportunities, but an initial map that can be used to build on to the same.

Pilgrimage Travel/Health Advisory Services

There is no risk rating and advisory services in India that provides travellers with information in the risk rating at different times of the year or on a general travel situation. There are no personalized services that provide information and questions to pilgrims health, security, medical information such as vaccination requirements, infectious diseases common in destinations, food and water safety, and tips on staying healthy while on pilgrimage. Also there are no travel information on emergency medical and other support services. Private weather forecasting and advisory business models do exists. This can be an extension to their business.

Personalised Emergency Medical Care and Evacuation

Membership based services for providing emergency medical care and evacuation is the need of the hour. The services should include evaluation, airlifting, trauma management from the disaster. The services should be followed by consistent protocols with coordination and rapid. One of the areas where a centralized control room which can co-ordinate with the victims and their family members is an essential part of the service. In case of international pilgrims, the service should provide assistance with passport documentation and visa clearances during emergencies, so that the border transits can be smooth.

Specialised Hospitals near the Disaster Zone

With the intensity of disasters increasing in occurrences, there is an opportunity for setting up small specialized hospitals that can cater to the disasters in a specialized way and can be an extension for the supply chain and logistics to the operations in the disaster zone. These hospitals can provide medical equipment, pharmaceuticals, and medical consumables to remote site support.

Medical College in Disaster Medicine in India

There are several institutes of excellence in India that provide courses and degrees in disaster management. However, like the US where there is a board of disaster medicine with special curriculum and licensure of working professionals in this field of medicine, there is no medical college or National Center of Excellence in India providing UG or PG courses. India can well be served by this branch of specializing doctors from a recognized Center of Excellence in Disaster Medicine.

A Public-Private Corporation for Disaster Risk Management

India is one of the countries that consistently ranks amongst the top-5 countries in the world where most of the disasters strike. The lack of faith in the state government of Uttarakhand by the faithful devotees of other states and independent operations by individual state governments to search, rescue and airlift the victims itself gives rise to the business of disaster risk management that could be outsourced to an independent company by these state governments rather than political oneupmnship! On a serious note, other countries that are as disaster prone as India such as Phillipines have used public-private partnerships to disaster risk management using community participation and consistently reduced disaster risks year on year! This will not only create employment opportunities in the community, but also infrastructure and logistics to handle risk mitigation measures on a real time basis.

Some Interesting Business Models in Place

There are some very interesting business models in place for disaster risk management around the world in operation. Some of the ones that need a mention are as under:

Reuters Alertnet:

AlertNet is a free humanitarian news service run by Thomson Reuters Foundation covering crises worldwide. The award-winning website provides news and information on natural disasters, conflicts, refugees, hunger, diseases and climate change.

International SOS:

International SOS is the world’s leading medical and travel security services company. Their enterprise services help organizations protect their people across the globe. Our teams work night and day from more than 700 locations in 76 countries.

Doctors Without Borders

Médecins Sans Frontières (MSF) is an international medical humanitarian organization created by doctors and journalists in France in 1971. Today, MSF provides independent, impartial assistance in more than 60 countries to people whose survival is threatened by violence, neglect, or catastrophe, primarily due to armed conflict, epidemics, malnutrition, exclusion from health care, or natural disasters. MSF provides independent, impartial assistance to those most in need. MSF also reserves the right to speak out to bring attention to neglected crises, challenge inadequacies or abuse of the aid system, and to advocate for improved medical treatments and protocols. In 1999, MSF received the Nobel Peace Prize.

Reflecting Forward

The events that have unfolded in the face of disasters in India require execution and not politicking. It is time private enterprise take over where Government has failed to deliver just like main stream healthcare to the masses, it is time for taking over Disaster Risk Management and Disaster Medicine in India.