My Tedx Talk on Inside-Out Approach to Innovating Healthcare Funding in India

KK’s Blogs n Presentations

Financial Planning in Turbulent Times

My virtual talk at GGNIMT on 20 March 2021

Prime Minister’s Task Force on Food and Agriculture Reforms

The Executive Summary of the Recommendations of Prime Minister (Atal Bihari Bajpayee) Task Force on Food and Agriculture Reform in India presented in November 1998

Also Read Blog: Food And Agri Reforms | Kapil Khandelwal KK

Also Listen Podcast

Covid Pandemic is Bust : The Population Pandemic Awaits

Introduction

Recently, the World Health Organisation (WHO) played Beating the Retreat on Covid-19 and proclaimed that the global emergency on Covid is Over. The end tally of the Covid War Losses:

- 765,222,932 confirmed cases;

- 6,921,614 deaths;

- Glaring short comings of healthcare infrastructure;

- Economic and social disruption:

- Nearly half of the world’s 3.3 billion global workforce are at risk of losing their livelihoods, pushing nearly 0.82 billion into extreme poverty

- 25% increase in prevalence of anxiety and depression worldwide, affecting the mental health and well-being of people of all ages.

- Entire food system is affected due to weather changes and disruptions in the supply chains, reducing access to healthy, safe and diverse diets.

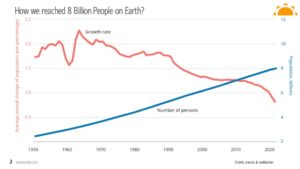

While the post Covid war reparations are underway, there was another bugle on the population front. Last year we added the 8th billion human on earth. This is going to be another pandemic in the waiting. The healthcare needs for 8 billion people is a horror war movie in the making. Closer home, India is going to be the most populated country in the world next year.

The Demographics of Population Pandemic

Global Population Pandemic

As a thumb rule, global population growth will stabilize when the birth rate and the death rate are equal. We will continue to grow till the fertility rate ie. the number of children born per woman falls below 2.1. As per various scenarios, the world population, currently around 8 billion, is expected to reach 9.8 billion in 2050 and 11.2 billion in 2100, and then decline gradually.

India’s Population Pandemic

India’s population is expected to peak at 1.65 billion by 2060 and then decline gradually. According to reports woman fertility rate falls below 2.1 by 2030. India’s demographic transition from a high-fertility and high-mortality society to a low-fertility and low-mortality society. (From 2.33 children per woman in 2015 to 2.03 children per woman in 2021, while the life expectancy at birth has increased from 67.7 years in 2015 to 69.4 years in 2021. The population pyramid also shows that the number of children under 15 years old peaked in 2011 and has been declining since then, while the number of elderly above 65 years old has been increasing steadily. Also read: According to a report by The Times of India, India’s population will stabilize only in 2050 (2047 is our Amrit Kaal Amrit Kaal : Budget 2022 | Kapil Khandelwal KK) when the death and birth rate will be balanced. Also we have a higher than usual healthcare acuity due to our genetic make up Tedx Archives | Kapil Khandelwal KK

Managing India Population Pandemic, Its About Quality of Life and Health

For the Covid pandemic, India quickly ramped up the production of Covid Vaccine and also played the vaccine diplomacy. Over billion doses of Covid vaccine was supplied globally to different countries apart from immunising billion Indians. India has built global scale capacity for facing the pandemics. India is also looking to champion the agenda of healthcare for the Global South in its Chairmanship for the G-20 this year. But the issue around the demographics of the population pandemic goes beyond providing for healthcare.

As we plan ahead for the Amrit Kaal 2047 when India’s population growth stabilises, I have been writing and speaking on what is required. Let’s use the Roti, Kapda, Makaan, Dava-Daru (the last one is already addressed in my Tedx Talk Read Healthcare For All | Kapil Khandelwal KK)

- Food security: We have to feed 1.6 billion mouths by 2047 two square mealsx365 days a year. We don’t have enough land mass to be able to produce food at that large quantum. Intensive, industrial scale agriculture would have to be introduced with Green Revolution 2.0. (see PM Task Force Report on Food and Agri Reform Food And Agri Reforms | Kapil Khandelwal KK)

- Water Scarcity: For sustaining life, we had addressed linking of north rivers to south rivers and regenerating the water table

- Sustainable Smart Cities: by 2047 over 60% of the population will be urbanized and would need sustainable and healthy living environment on a very concentrated urban land mass with lower levels of pollution.

- Healthcare for All: We urgently need to invest USD 360 billion to come up to global standards on healthcare metrics. In addition, another USD 675 billion in the healthcare and life sciences value chain to sustain our current and future population and the health acuity today.

Let’s live and let live in a world that can sustain this population pandemic!

Assisted by ChatGPT 😉

Also See Presentations

Also Listen to Podcast

How are Things Moving? The Future of Mobility

Podcast

Confused about which personal mobility option to select. The traditional petrol/diesel option, or the hybrids or fully electric vehicles. The post covid scenario globally for the automotive and mobility industry is not so clear. QuoteUnquote with KK and Chetan Maini, Co-Founder and Chairman at Sun Mobility and Creator of Reva, India First Electric Car in 1999 we discuss about where the future of the automotive and mobility is moving. This is on the backdrop of Elon Musk and Tesla announcing a USD 10Tn investment to make the earth more sustainable. Chetan’s keynote presentation at Nasscom Product Conclave 10 years ago looked like a cut and paste in #Tesla Investor Day Presentation.

Tesla Investor Day

Sustainability of Delivery Apps

The Future of Indo-US Relations. Growing Positively by ‘Quad’rapuling

Podcast

QuoteUnquote with KK and Dr. Mukesh Aghi, President and CEO, US-India Strategic Partnership Forum where we discussed Trump arrest, India’s NATO membership, US Visa issues, geo politics, trade, investment and fostering a growth-oriented relationship between the two countries.

Bidenomics and Pivoting Indo-US Geopolitics and Investments

Bidenomics | Kapil Khandelwal KK

Previous Podcasts

Asian Trade and Geo Politics in the Face of Russia-Ukraine Conflict

QuoteUnQuote with KK and Dr. Parag Khanna Founder & Managing Partner of FutureMap and Young Global Leader of the World Economic Forum www.paragkhanna.com

World in Biden Era – Indo-US Relations, Geopolitics and Investments

QuoteUnquote with KK and Sridhar Chityala, Chairman and Managing Partner Elevate Innovation Partners. He is a thought Leader on Indo-US GeoPolitics, Trade and Investments and globally recognized leader in the financial services industry on the future of Indo-US ties

Growing Human Connect Positively: A Playbook

Podcast

In a world which is getting more lonelier, QuoteUnquote with KK provides a hug of “Human Connect” across various dimensions with Manoj Gursahani, Author, Business Coach, Global Strategist Home | Manoj K Gursahani (manojgursahani.com)

The World Happiness Report from 2021 has been highlighting the increasing loneliness in the world and its impact on happiness in humans.

It’s in our human DNA and brain to connect with other humans as we are most evolved species on earth. Human connection lowers anxiety, depression, and suicide ideation, and how improving our connection with ourselves helps us better connect with others. Lily neurosciences. cpp human capital did an international study in 2008 and they asked the question of people tell me about conflict do you have it in your life 85 percent of the respondents said yes they have conflict with other human beings at times in their life 29% nearly one-third say they have conflict with others in their life always or frequently they asked why is there conflict between you and others 49% nearly have said it’s because of personality clashes or ego as I study that I see for me that personality clashes is the result of ego. So does human connect vary human personality type to type. How do we increase our human connection quotient.

World Happiness Report 2022

Previous Podcasts

Blindspot : The Global Rise of Unhappiness: How Leaders Missed It?

QuoteUnquote with KK and Gallup Team

Rohit Kar, Relator | Restorative | Futuristic | Analytical | Significance

Kristjan Archer, Command | Competition| Activator | Achiever | Arranger

Book Link : https://amzn.eu/d/fGuDA3y

Good Governance and Happy Citizens

QuoteUnquote with KK and Dr Kiran Bedi, Author, Woman Leader, Social Activist, India’s first and highest-ranking Woman Police Officer, Asian Nobel Peace Prize Winner, Politician and Ex-Governor of Pondicherry

Book Link: https://amzn.eu/d/b54xfL4

Common Man’s Happiness Economics

QuoteUnquote with KK and K. V. Subramanian, Ph.D., Professor of Finance, Indian School of Business; Ex Chief Economic Adviser, Govt of India

To Happiness & Beyond: Business Models for Delivering Beyond Happiness

QuoteUnquote with KK and Jenn Lim author of Beyond Happiness & CEO of Delivering Happiness (DH)

Karan Behl is Founder and CEO of Happiitude

Book Link: https://amzn.eu/d/cr1evAa

Everlasting Peace and Happiness for the World in the ISKON Philosophy

QuoteUnquote with KK and Gauranga Das, Legendary Monk and Director of the Govardhan Ecovillage, and Co-President of the ISKCON Chowpatty temple

How Can Social Tech Ventures Deliver Better Impact and Happiness to Rural India – With or Without 5G?

QuoteUnquote with KK and Dr Aaditeshwar Seth, Author, Founder Gram Vaani, Associate professor in the Department of Computer Science and Engineering at IIT Delhi

Book Link: https://www.cse.iitd.ernet.in/~aseth/act.html

Living in the Age of Disasters: From Multilateral to Bilateral Aid

Introduction

In July 2013, I wrote an article titled The Business of Disasters in my column (w)Health Check ((W)Health Check | Kapil Khandelwal KK). The idea in the article was to encourage the corporate sector in India to innovate business models to manage disasters. (see the text of the article below). The world in the second decade of the twenty first century has witnessed all the types of disasters conceivably possible that has left behind deaths and devastation. A lot has been spoken and written on biological disaster during and post Covid-19 pandemic. The ability to impact these threats is beyond control of the people and more in the hands of the healthcare systems managed by the relevant Governments around the world. We should now discuss on the Geophysical and Hydro-Metrological Disasters where there is still lack of understanding.

The organizational set up and confidence in the multilateral agencies has definitely been dented. What alternatives does the world have now to face the incoming disasters?

Global Maps of Geophysical and Hydro-Metrological Disasters

The global map of Geophysical and Hydro-Metrological Disasters provides that not the regions around the world are at mortality risk of such disasters.

There are many prediction models available to inform where these disasters will hit next with a fair amount of accuracy. Therefore, unlike biological disasters which are hard to predict before they strike, there is a measure of preparedness that is possible to manage Geophysical and Hydro-Metrological Disasters when they strike. Still the multilateral agencies have not been preparing to meet these eventualities.

Lessons from Recent Disasters

Biological Disaster: Covid 19 Outbreak

During the Covid-19 outbreak, we have witnessed how global multilateral organisations like the World Health Organisation (WHO) were incapable of dealing with the situation that the then US President Donald Trump decided to pull out of the WHO as its major sponsor. Moreover, the manner in which the WHO approved the covid vaccine and its effectiveness is now out. As a result countries like India has to suffer in releasing its vaccine to its own people or supply it globally. Months later release of other countries vaccines, did India supply its more effective vaccine to over 100 countries on bilateral basis. But the delay India faced by WHO for approval of its vaccine lead to flooding of ineffective vaccines.

Geophysical and Hydro-Metrological Disaster

Recently earthquakes and floods which have hit several countries, the multilateral agencies such as International Red Cross were not capable enough to handle the devastation. As a result, many countries have responded to the disaster based on their relations with the devastated country. Turkey earthquake is an example. We still do not know what is going to happen. But major first responders to such countries were on bilateral basis. Here also India responded to Turkey’s request by sending its National Disaster Response Force (NDRF) teams. It’s another issue that Pakistan did not allow Indian aircraft passage through its airspace to reach Turkey faster.

Rise of Bilateralism and Its Risks

Since late 2010s, the financial support received of the member countries to the multilateral countries has been gradually reducing. They have been stretched to maintain their administrative budgets versus funding disaster management operations.

The additional capacity for disaster management which strikes countries in one stroke of nature, lies with other countries in limited measure as multilateral agencies are not adequate enough to handle to situation. These capabilities when aggregated would barely be sufficient to manage the crisis through the disaster. Let’s also understand that bilateral aid and support by other countries is motivated by diplomatic relations and ties. The current Turkey and Syria earthquake demonstrates this vividly. Turkey got the majority of the bilateral aid and support while Syria was not. Another example is the great floods in Pakistan where India’s aid was not requested nor India provided it. Moreover, much of the aid that Pakistanis received was never delivered to the people suffering. This acerbates the plight of the people suffering in these disasters. Therefore geo-political considerations come into play to support disaster management bilaterally. This brings to the point of the risks of rising bilateral flow of disaster management aid, support and services to countries in disaster. Some of these include:

- Bilateral aid and support may come with the strings and expectation of support to the doners by the receivers in international politics, trade and commerce at a later stage

- The aid and support may not be fairly distributed across the political boundaries which are impacted

- Like many aid projects that I have worked in Africa, end abruptly as soon as the crisis is stabilized. The longer-term rehabilitation is not considered in bilateral aid and support. The same may be true in current Turkey-Syria earthquakes.

- These incidents also become an opportunity to debt trap the countries which are financially and economically week. Pakistan is a case in point after the floods to Chinese debt-trap.

- The checker board of international diplomacy in such circumstances may create more tensions for the donors in the future when other countries compare the situation in their own backyard when it had occurred and who stood up to support them bilaterally.

- Political unrest in the donor countries over bilateral support to other countries provided.

Given these risks, would it not be prudent to organize private enterprise business models with innovative financial models to sustain these businesses (see my article below). These were initial thoughts in 2013 by me. But given the frequency of disasters the world and its countries are facing, it become evident that rather than expecting bilateral aid and support, the fully life cycle of disaster management can be managed by private enterprises with full disclosures and accountability. Many ESG and impact funds would definitely invite such ideas of such private enterprises.

Article: The Financials of Disasters

It is time for the corporate sector to take over disaster risk management and disaster medicine in India

Background

Probably the greatest concentration of pilgrims in any region in the world occurs in India’s mountain regions of Himachal Pradesh, Uttaranchal and Uttar Pradesh, where 9.3 million pilgrims each year arrive at the major entry point into the Pahari region. Between 2001 and 2010, the number of visitors to the state rose nearly 200 percent to 30.3 million. Major Hindu shrines located in the state, about 70 percent of the tourists who visit the state visit religious sites. However, last months pilgrim disaster in Uttarakhand with the search and rescue operations for the pilgrims needs to be reviewed. With large-scale politicking, drama and oneupmanship by the political parties in the aftermath of the disaster, requires an assessment on the failure of the government in providing services in such situations and leaves me wondering on the areas where different business models can be operated by the private sector in the health and well being of people in such situations.

| 1. Sequence of a disaster: “befores”, “durings” and “afters”.

2. Triggering events and coupling causes. 3. Large-scale damage to human life and environment. 4. Large economic costs. 5. Large social costs. 6. HOT (human, organizational and technological) and RIP (regulatory, infrastructural and preparedness) factors. 7. Multiple stakeholder involvement and conflict. 8. Immediate and longer-term responses. 9. Crisis resolution attempts. 10. Focus on symptoms not causes. |

What is Disaster and Disaster Medicine?

A disaster is not a “crisis” in the traditional meaning of the word – a situation in which important decisions involving threat and opportunity have to be made in a particularly short time – rather, disasters involve management procedures which must be maintained and management problems coped with under conditions of major technical emergency involving threats of injury and loss of life. (See Box). There are two types of disasters – natural and technological disasters. Natural disasters include three specific groups:

- Hydro-meteorological disasters. Including floods and wave surges, storms, droughts and related disasters (extreme temperatures and forest/scrub fires), and landslides and avalanches.

- Geophysical disasters. Divided into earthquakes and tsunamis and volcanic eruptions.

- Biological disasters. Covering epidemics and insect infestations.

The technological disasters comprise three groups, which are:

- Industrial accidents. Such as chemical spills; collapses of industrial infrastructures; explosions; fires, gas leaks; poisoning; radiation.

- Transport accidents. By air, rail, road or water means of transport.

- Miscellaneous accidents. Collapses of domestic/non-industrial structures; explosions; fires.

The effects of theses disasters can be view on health and well being from five different perspectives. These include:

- preparedness and availability of medical and health facilities, services, personnel and equipment;

- immediate casualties and deaths caused by the disaster;

- secondary illness and deterioration of health conditions following the disaster;

- destruction or damage to medical and health centres and services;

- response capability of the health services and the capacity for post-disaster recovery.

The response to health problems of such magnitude, under adverse and literally catastrophic conditions, cannot be sufficient with mere emergency medicine or just the provision of relief. Disasters, particularly the one in Uttarakhand are not merely very large accidents; they involve complex public health issues and health management problems at a time when the normal coping mechanisms are disrupted or even out of action. In recent years, the health profession has, to this end, developed new approaches and a new discipline now referred to as “disaster medicine”.

| Disaster Medicine is the study and collaborative application of various health specialties – e.g. paediatrics, epidemiology, communicable diseases, nutrition, public health, emergency surgery, military medicine, community care, social medicine, international health – to the prevention, immediate response, humanitarian care and rehabilitation of the health problems arising from disaster, in cooperation with other non-medical disciplines involved in comprehensive disaster management. |

In case of floods like that in Uttarakhand the risks of infectious diseases and of malnutrition are real, and the necessary personnel, medicine and supplies should be geared to those needs.

Different Business Models and Opportunities Addressing Disasters in India:

With the occurrence and intensity of disasters increasing in India, there are several business models that we can look as. This is not an exhaustive assessment of the opportunities, but an initial map that can be used to build on to the same.

Pilgrimage Travel/Health Advisory Services

There is no risk rating and advisory services in India that provides travellers with information in the risk rating at different times of the year or on a general travel situation. There are no personalized services that provide information and questions to pilgrims health, security, medical information such as vaccination requirements, infectious diseases common in destinations, food and water safety, and tips on staying healthy while on pilgrimage. Also there are no travel information on emergency medical and other support services. Private weather forecasting and advisory business models do exists. This can be an extension to their business.

Personalised Emergency Medical Care and Evacuation

Membership based services for providing emergency medical care and evacuation is the need of the hour. The services should include evaluation, airlifting, trauma management from the disaster. The services should be followed by consistent protocols with coordination and rapid. One of the areas where a centralized control room which can co-ordinate with the victims and their family members is an essential part of the service. In case of international pilgrims, the service should provide assistance with passport documentation and visa clearances during emergencies, so that the border transits can be smooth.

Specialised Hospitals near the Disaster Zone

With the intensity of disasters increasing in occurrences, there is an opportunity for setting up small specialized hospitals that can cater to the disasters in a specialized way and can be an extension for the supply chain and logistics to the operations in the disaster zone. These hospitals can provide medical equipment, pharmaceuticals, and medical consumables to remote site support.

Medical College in Disaster Medicine in India

There are several institutes of excellence in India that provide courses and degrees in disaster management. However, like the US where there is a board of disaster medicine with special curriculum and licensure of working professionals in this field of medicine, there is no medical college or National Center of Excellence in India providing UG or PG courses. India can well be served by this branch of specializing doctors from a recognized Center of Excellence in Disaster Medicine.

A Public-Private Corporation for Disaster Risk Management

India is one of the countries that consistently ranks amongst the top-5 countries in the world where most of the disasters strike. The lack of faith in the state government of Uttarakhand by the faithful devotees of other states and independent operations by individual state governments to search, rescue and airlift the victims itself gives rise to the business of disaster risk management that could be outsourced to an independent company by these state governments rather than political oneupmnship! On a serious note, other countries that are as disaster prone as India such as Phillipines have used public-private partnerships to disaster risk management using community participation and consistently reduced disaster risks year on year! This will not only create employment opportunities in the community, but also infrastructure and logistics to handle risk mitigation measures on a real time basis.

Some Interesting Business Models in Place

There are some very interesting business models in place for disaster risk management around the world in operation. Some of the ones that need a mention are as under:

Reuters Alertnet:

AlertNet is a free humanitarian news service run by Thomson Reuters Foundation covering crises worldwide. The award-winning website provides news and information on natural disasters, conflicts, refugees, hunger, diseases and climate change.

International SOS:

International SOS is the world’s leading medical and travel security services company. Their enterprise services help organizations protect their people across the globe. Our teams work night and day from more than 700 locations in 76 countries.

Doctors Without Borders

Médecins Sans Frontières (MSF) is an international medical humanitarian organization created by doctors and journalists in France in 1971. Today, MSF provides independent, impartial assistance in more than 60 countries to people whose survival is threatened by violence, neglect, or catastrophe, primarily due to armed conflict, epidemics, malnutrition, exclusion from health care, or natural disasters. MSF provides independent, impartial assistance to those most in need. MSF also reserves the right to speak out to bring attention to neglected crises, challenge inadequacies or abuse of the aid system, and to advocate for improved medical treatments and protocols. In 1999, MSF received the Nobel Peace Prize.

Reflecting Forward

The events that have unfolded in the face of disasters in India require execution and not politicking. It is time private enterprise take over where Government has failed to deliver just like main stream healthcare to the masses, it is time for taking over Disaster Risk Management and Disaster Medicine in India.

Growing into the Space Frontiers

Podcast

QuoteUnquote with KK and Sanjay Nekkanti is the CEO and founder of Dhruva Space Private Limited, the company behind sending the private satellite into space from India 2023

We have all dreamt about going into space. Listen to India’s space entrepreneur who dreamt it and launched India’s first private satellite into space. In this podcast, we discuss the India’s private space and satellite program, space research, innovation and start up ecosystem, growth opportunities for Indian space entrepreneurs, future space race and economy how can India win the race.

Also Read:

Also Listen:

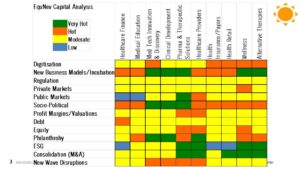

2023 India Healthcare and Lifesciences Investment Outlook

Since 2013 our algos have been accurately predicting the investment heatmap in the healthcare and life sciences in India which were predicting with 95% accuracy on the sectoral investment cycle in India till the end of 2019. Since the Covid Pandemic in 2020 we lowered levels of prediction accuracy like we started back in 2013. Covid-19 pandemic killed over 23 million people globally. 2022 has brought new headwinds, some we haven’t seen in over 40 years. Healthcare spending will fall in 2023 in real terms, given high inflation and slow economic growth, forcing difficult decisions on how to provide care. Digitalisation of the healthcare system will continue, but the use of health data will come under stricter regulation. A New world order under the current geo politics fragmentation and multilateral world is bringing India to the forefront. It’s vaccine diplomacy, effective and cost-effective therapeutic solutions is a game changer for India.

2023: A Year of Newer Normal

Since the Great Chinese famine of 1959, for the first-time life expectancy as per UN, Covid-19 had been cut by 1.7 years off global life expectancy, reducing it to 71.1 years. While a recovery probably began in 2022, the UN calculates that 2023 will be the year when life expectancy first exceeds 2019 levels. The investment thesis with most of the investment managers in the current scenario is more of a long view on healthcare infra which are less tied to economic cycles and an imminent slow down globally. Some of the investment risks the healthcare and lifesciences sector faces include rising real interest rates, increasing price inflation for healthcare products and services in the face of weakening in consumer spending, reshoring the supply chains and the wars, both trade and terriotorial. Digital businesses are equally going to be impacted. ESG and impact funding is waiting for deployment.

Let’s relook at the board trends for 2023 in terms investment activity and trends.

Healthcare Financing

2021 was an all time-high for healthcare financing sector due to emergency and non-discretionary spend on healthcare. Health Tourism related funding is only going to take off in Q3 after the current wave tides down. Consolidation activity to slow down.

2023 Outlook: Moderate

- What’s going wrong: right bite for the consumers, reach and penetration, higher debt financing costs, slower non-discretionary and elective healthcare spend, delaying of healthcare spend and health tourism, new wave restrictions, shortage of digital workforce

- What’s going right: India stack digitisation, agetech, consumer borrowing to spend on electives

Medical Education

Skilled manpower shortages is the key driver for growth. All the students who have returned back from Ukraine need to be accommodate in our current system Regulatory reforms are urgently required to push digitization and newer business models for upskilling existing workforce. Churn in ownership of assets due to consolidation activity will continues at a faster pace.

2023 Outlook: Moderate

- What’s going wrong: regulation, corruption, no vision, skill shortages, alignment to new age care, increasing debt burden

- What’s going right: skill demand, digitisation, manpower-led business models creating their own content or tying up with larger established players, cross-border students coming to India, export of clinical manpower to the West

Med Tech Innovation and Life Sciences Discovery and Clinical Development

India has proven to be the vaccine supplier to the world in 2022 with over forty percent of the world’s pre-qualified vaccine products are made in India. Capacity creation and new product development need to be accelerated particularly in infectious diseases and some niche segments. Reshoring and government policies for that need to be accelerated. Global investment and partnerships is on the rise in 2023. Patent expiry of some of the blockbusters in the US are a huge opportunity.

2023 Outlook: Moderate

- What’s going wrong: Innovation pipeline, IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration, global collaboration and partnerships

- What’s going right: Human capital, cost advantage, reshoring the supply chain, Make in India

Pharma and Therapeutic Solutions

Several players are going to go for the IPOs in 2023. Reshoring the supply chain is moving slowly. The Government production linked incentive is not moving as intended in the medtech, intermediates, APIs. The capital expenditure in creating world-class green infra is still to take off.

2023 Outlook: Hot

- What’s going wrong: price controls, policy log jam, innovation and scale up, cost competitiveness, exit of PLI incentives, scale of capex, Margins pressure, IPO valuation

- What’s going right: cost advantage, distribution infrastructure, Government incentive programs, blockbuster going off patent in the US, ESG funding entry

Healthcare Providers

2022 was a negative year for almost all the listed stocks. With higher interest rates, funding costs for have increased. Inputs such as steel, cement, etc, have also shot up increasing the capex per bed. Newer sources of funding green healthcare infra as a long-term bet which are less tied to economic cycles is emerging. Digitalisation will slow down even further as consumers go back to the old ways. Costs and profitability pressure will increase to maintain the investor interest. PE valuations will continue to get right adjusted to market valuation.

2023 Outlook: Moderate

- What’s going wrong: margin pressures, price controls, execution of programs on the ground, PPP in healthcare, supply and demand mismatch in micromarkets, debt financing costs, gun powder churn, operating cash runway, liquidity and working capital crunch

- What’s going right: Asset-lite models, demographics

Healthcare Insurance

The IPOs in 2021 in the sector have created uncertainty in valuation and investor sentiment. The sector will continue to grow as it did in 2022. New products and customer segmentation is going to be the growth drivers

2023 Outlook: Hot

- What’s going wrong: product fit to consumer needs, product approvals, loss ratios, operating cash runway, human capital reduction, consumer offtake and demand, IPOs pricing and valuation

- What’s going right: Consumer demand, digitisation, new products

Health Retail

Spends on healthcare are slowing down and so is the discretionary spend. Falling service levels and consumer trusts is at an all-time high. Costs and margin pressures is going to be more acute. Only one major IPO expected in 2023. Many of the late stage start-up are going to scale down or not raise the capital at the expected valuations.

2023 Outlook: Moderate

- What’s going wrong: regulation, consolidation, slower consumer spending, funding drying up, operating cash runway,

- What’s going right: Consolidation, newer cross-vertical innovative business models, profitability focus and valuation being right adjusted

Wellness

Growth which tapered down in 2022 is still going to be sluggish in 2023 as consumers cut back their spends. Digital business model innovation is still lagging behind. Medical wellness tourism will be recover in Q3 of 2023. Corporate Wellness spends which also scale down even further. PE funding is going to slow down even further as valuations squeeze even downwards with margin pressure. Expect one major IPO here.

2023 Outlook: Hot

- What’s going wrong: regulation, maturity to scale, down round valuations, slowing of wellness spends, manpower and cost pressures

- What’s going right: newer cross-vertical innovative business models,

Alternative Therapies

Growth and new customer acquisition is the new mantra in 2023 as consumer spending decelerates further. New products and therapies that have accessed funding in 2021are going to find it difficult to raise at the expected valuation. Large MNCs are also entering in this space to fight for the consumer’s mindshare. Funding crunch is going affect growth. Expect an IPO. Some of the players may scale down or shut down due to funding. Consolidation activity will increase.

2023 Outlook: Hot

- What’s going wrong: maturity to scale, consumer education and confidence, clinical research, new product development, growth, funding crunch,

- What’s going right: discretionary consumer spending, newer cross-vertical innovative business models, mainstream complementary treatment.

Let’s wish that we focus on building trust in healthcare for the consumers in 2023 and there is peace across for the world to come out of recessionary trend that would boost the investor confidence across.

Happy investing and stay safe!

Also Listen: